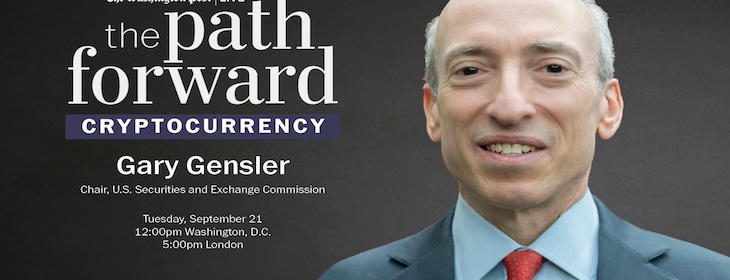

SEC Chairman Gary Gensler speaks on crypto

The Securities and Exchange Commission plans to take enforcement action on the blockchain and digital currency industry; on September 21 at 12:00 pm EST, Gary Gensler the U.S. Securities and Exchange Commission Chair provided his insights on cryptocurrency markets with the Washington Post in a webinar titled “The Path Forward: Cryptocurrency with Gary Gensler.”

Gensler mainly talked about the cryptocurrency industry, the businesses that operate within it, the lack of regulation and enforcement that he sees in the industry, and how it is catalyzing lawmakers to take action.

Key takeaways:

Gensler spoke with Washington Post columnist David Ignatius for thirty minutes, and their conversation revolved around one central topic: why we are going to see more enforcement in the blockchain and digital currency markets.

First Gensler explained why most cryptocurrencies are securities, and therefore, fall under the jurisdiction of the SEC. In particular, he spoke about digital currency lending platforms and exchanges since they often list tens, hundreds, and even thousands of the cryptocurrencies that are most likely securities.

“If these tokens, and there are five or six thousand different projects, if these tokens have the attributes of an investment contract or a note or equities or bonds, in essence, one of the core issues is that there are platforms, trading platforms, where you can buy and sell these tokens, lending platforms, where you can earn a return on these tokens, that have not just dozens of tokens, but sometimes hundreds or thousands of tokens, and its highly likely that they have on these platforms securities, investment contracts, or notes, or others that fit the definition of security,” said Gensler.

“ Those platforms should come in, they should figure out how to register, but not many have. I do really fear we will keep bringing these enforcement cases, but there’s going to be a problem, there’s going to be a problem with lending platforms, and trading platforms, and frankly, when that happens, I think a lot of people are going to get hurt.”

He related the thousands of digital currencies that exist to the many currencies that existed during the wild-cat banking era in the 1800s, where each bank issued its own currency which created competition and a market around these currencies.

“We’ve experimented historically with private forms of money in the U.S. We had banks issuing banknotes and they competed, Philadelphia banknotes were different than Baltimore, and even within Philadelphia, there were different banknotes competing. That [system] had a lot of cost, a lot of problems, and then Abraham lincoln put in place an oversight called a controller of the currency, and then the federal reserve came 50 years later,” said Gensler.

“Public money has a certain place around the globe, private monies usually don’t last that long, so I don’t think there’s long term viability for five or six thousand private forms of money, history tells us otherwise so in the meantime I think its worth it to have an investor protection regime placed around this.”

General takeaway

Ultimately, Gensler expressed that cryptocurrencies and the products and services around them are innovative; this emerging sector forced the world to evolve and adapt to keep pace with the developments and offerings within it.

However, Gensler feels that the cryptocurrency industry is becoming too large in a negative way; Gensler called cryptocurrencies “highly speculative” and he called stablecoins “poker chips” that allow individuals to play in the crypto-casino that has a market cap of roughly $1.8 trillion.

Before the industry gets to the point where an event takes place that has a ripple effect that causes damage to many of the market participants, Gensler would like the SEC to step in and improve the investor and consumer protections, tax compliance, anti-money laundering, and financial stability around the emerging blockchain and digital asset markets.

Source: Read Full Article