New Fintech Startups to Watch In 2021

The fintech sector has slowly but surely established itself as one of the most significant disruptors of our generation.

For the first time in recent history, small businesses and start-ups are challenging the status quo in the financial industry, competing with big banks and providing customers with a much-needed alternative to the traditional services people are accustomed to.

Incredibly, the global fintech industry is expected to reach $124.3 billion by the end of 2025, with a Compound Annual Growth Rate (CAGR) of 23.84 percent, which explains why so many new and exciting start-ups are springing up in this sector.

In general, many of the most successful fintech start-ups focus on personalization, integration, and connectivity, all of which are lacking in mainstream banks and traditional financial solutions.

After all, it’s 2021, and consumers expect more than just a transaction with minimal interaction when engaging with their financial products.

However, as more businesses enter the financial technology space, it can be difficult to sort through them all and identify the best from the rest.

With this in mind, we’ve compiled a list of the top three fintech companies to keep an eye on in 2021, as well as what you can anticipate from them in the years ahead.

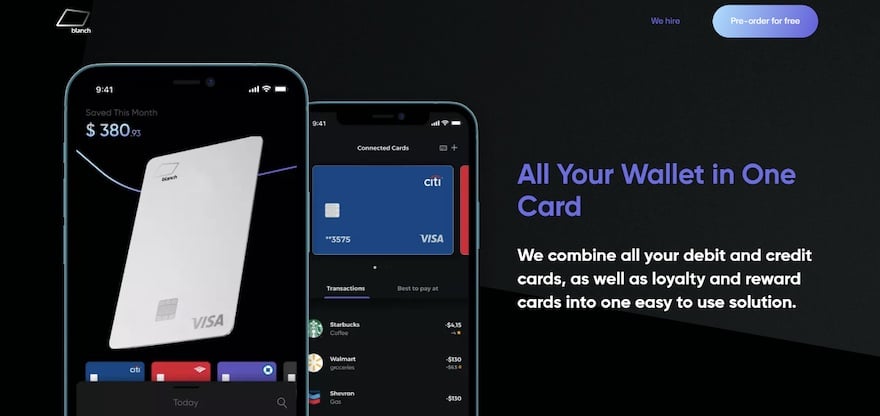

Card Blanch

These days, our wallets are full of various cards, making it a little bit difficult to keep track of our finances. The average American carries four credit cards with them at any one time.

Maybe it’s a debit card from Wells Fargo, a credit card from Bank of America, and let’s not forget the loyalty cards with Starbucks, Target, and Barnes and Noble.

But what if you could condense all of these accounts into one handy card that you can manage through a smartphone application?

Well, that’s precisely what Card Blanch has developed with their innovative one-card solution. Using their slick application, you can combine all your debit and credit cards, as well as loyalty and reward cards, into one easy-to-use solution.

Card Blanch will automatically apply merchant discounts and rewards when you use their service, which means you’ll never have to carry all of your loyalty cards with you at once, freeing up space in your back pocket.

Furthermore, within their application, their user-friendly software provides you with comprehensive spending insights. This eliminates the need to install third-party software to manually track all of your transactions across multiple accounts.

Instead, Card Blanch collects all of your spending data in one place, making money management and budgeting much more straightforward.

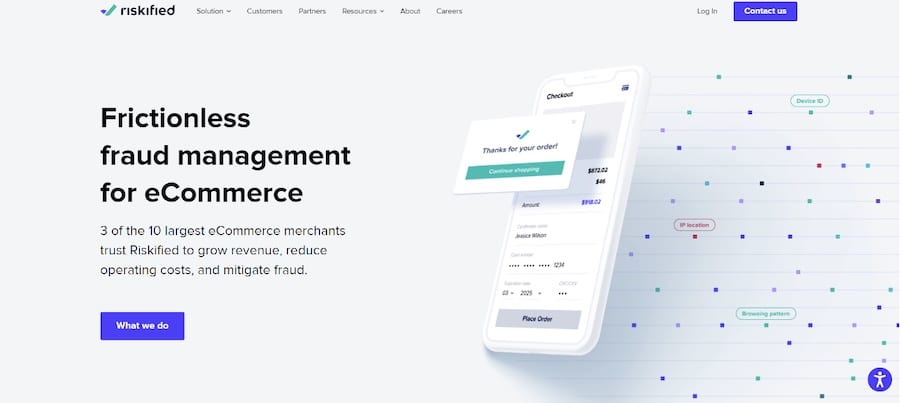

Riskified

Over the past few years, eCommerce has been booming, especially since the start of the global pandemic, where more people turned to digital solutions than ever before.

However, where there is money to be made, there will always be scammers and fraudsters looking to take advantage. In fact, eCommerce fraud is estimated to cost over $20 billion by the end of 2021 through methods such as chargebacks, identity theft, and affiliate fraud.

Riskified is an AI-powered platform that looks to solve many of these issues by helping e-commerce businesses secure themselves by allowing them to quickly distinguish between genuine and fraudulent requests.

With tools like customized dynamic checkouts, chargeback protection and guarantees, payment optimization, and advanced account security, Riskified ensures frictionless access for good customers, while stopping malicious account takeover attempts.

In other words, the platform makes it easier for legitimate shoppers to convert into customers while also fixing leaks in the e-commerce purchase funnel and strengthening customer relationships.

Riskified’s platform, which uses machine learning to collect data from several of the world’s top online retailers, creates network effects that drive more sales and lower costs for its merchants.

This enables online retailers to build trusting connections with their customers by reducing fraud risks and maximizing revenue-generating opportunities.

Spring Labs

There have been many fintech start-ups that have recently emerged intending to challenge the old approach of determining an individual’s creditworthiness.

For many years, this has been one of the major sources of frustration for traditional banking customers, which is also one of the biggest hurdles people face when trying to secure new lines of credit.

Spring Labs, fortunately, is one of the fintech start-ups attempting to address this issue.

They use powerfully transparent blockchain technology and real-time data ledger software to facilitate secure data exchange between organizations.

The platform assists businesses in preventing fraud by verifying identities utilizing a range of products and income stability indicators, protecting customer data, and streamlining the credit transaction approval procedure.

This opens up financial services to people with poor credit histories by incentivizing new firms to supply data that was previously unavailable to credit reporting networks.

Their platform has the potential to provide global credit access to billions of people across the world who are often without any formal representation in the credit ecosystem.

Final Word

Fintech start-ups are already numbering in the thousands, providing much-needed innovation to the financial sector.

With that said, the three companies highlighted in this article appear to be well-positioned to make a significant impact in their respective industries by providing high-value solutions to some of the most persistent problems.

It’s unclear where they’ll go from here, but for the time being, it appears they’re doing a great job at promoting rapid innovation within their sectors, which means we’re likely to see further improvements from them in the future.

Source: Read Full Article