Legal Battle Ensues Over Binance’s Acquisition Of Voyager Digital- Here’s Why. – Coinpedia Fintech News

The Voyager Digital deal with Binance.US has faced legal challenges from financial regulators seeking to stop the acquisition. Binance.US won the bid to acquire Voyager Digital assets last December, but the deal has not gone through yet. In the recent hearing with Michael Wiles, a Bankruptcy Judge in the Southern District of New York, Binance.US received a go-ahead notice to acquire Voyager assets.

As a result, Binance.US is to remit approximately $20 million to Voyager Digital to facilitate the restructuring process. Notably, Binance.US is expected to benefit from more registered users as Voyager creditors are to create an account with the exchange before getting compensated.

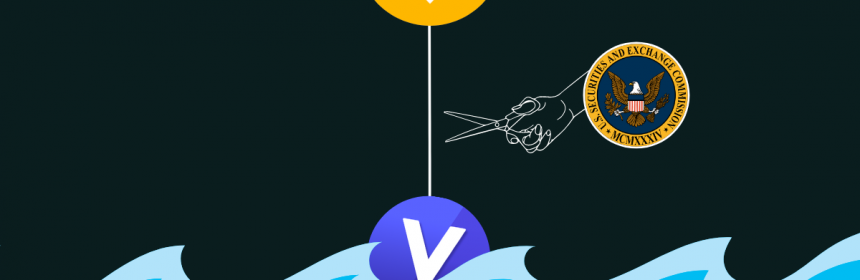

The United States DoJ and the SEC have not been pleased with the recent ruling and have filed a motion to oppose the acquisition.

According to a notice of appeal filed late Thursday, the United States Department of Justice challenges Judge Wiles’ decision to approve the $1 billion acquisition of Voyager Digital by Binance.US. Notably, the United States financial regulators claim Binance.US is offering unregistered securities.

Voyager Creditors and Debtors Work Together

Legal Battle Ensues Over Binance’s Acquisition Of Voyager Digital- Here’s Why!

In a series of tweets, the Voyager Official Committee of Unsecured Creditors indicated that the Binance.US acquisition deal is the best path forward for Voyager customers to maximize their recoveries. As such, the Voyager Official Committee of Unsecured Creditors has indicated that it will work closely with the debtors to oppose any appeal by the government agencies.

“Based on certain statements made by government objectors, we anticipate that the confirmation order will be appealed. The UCC will work with the Debtors to oppose any appeal. However, an appeal could significantly delay creditor recoveries,” the Voyager Official Committee of Unsecured Creditors indicated.

Nonetheless, Voyager could proceed with the liquidation plan if the acquisition deal does not go through.

Source: Read Full Article