Formation FI Completes $3.3 Million In Strategic Sale Round to Revolutionize DeFi Portfolio Construction

Formation Fi, a cross-chain risk parity smart farming 2.0, has announced that it has closed a funding round with $3.3 million from reputable venture capitalists and also private investors. According to the firm, some of the participants in the closed round include Polygon, Synthetix, Bancor, Kenetic, Spark Digital Capital, Kosmos, X21 Digital, AU21, Momentum 6, MarketAcross, GenBlock, Brilliance Ventures, Shima Capital, and GBV Capital.

Additionally, Formation Fi noted that up to 18 top-tier private investors also took part in the completed funding round. Notably, the funds are expected to be used in the development of the firm’s risk parity protocol. The firm aims to revolutionize the decentralized financial ecosystem (Defi) portfolio construction. By doing so, it will provide users with insights to avoid rug pulling and also instances of sustained losses.

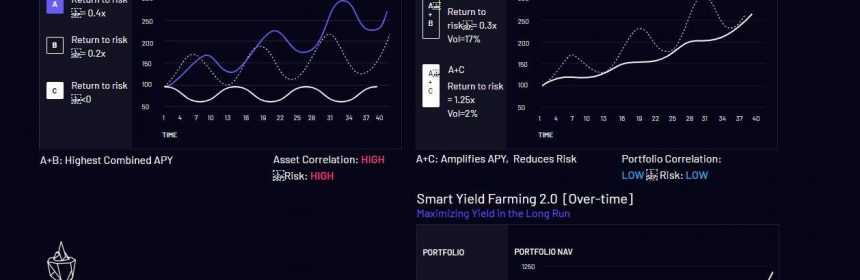

“Formation Fi has dubbed the concept Smart Farming 2.0 and envisions it as an advancement to defi’s current obsession with speculative yield chasing without much regard for risk. With risk parity-inspired smart yield farming 2.0, users get to tailor their level of exposure while receiving guidance from the protocol which is engineered to reduce risks posed by both bull and bear cycles,” the firm noted in a press release.

In a bid to provide the best services in the Defi ecosystem, Formation Fi anticipates working with the best startups in the decentralized financial ecosystem industry. Notably, the firm announced it seeks to create a founders’ club to attract only the Defi pioneers in order to work with them on a long-term basis.

“We are proud to be building on the collective wisdom of some of DeFi’s first pioneers. With our founders’ club approach, we are focused on coming together to build and amplify this still-experimental ecosystem and evangelize Smart Yield Farming into the world of open finance,” noted Formation’s Co-Founder Kristof Gagacki.

The promises to deliver high returns based on market insights, besides prioritizing digital assets diversification. “Through prioritizing secular diversification, the risk parity rebalancing mechanism sorts smart-asset allocation by pairing countertrend assets. This allows for iso-diversification construction to occur within our index coins to minimize risk fluctuations at a fundamental level – as it can detect levels of asset behaviors,” the company highlighted on its official website.

The company has its own native token dubbed $FORM that can be used on governance issues and liquidity pools.

Source: Read Full Article