'Ethereum Is Worth $348,000 If Solana's Current Fair Price Is $250', Pundit Talks SOL Being Overvalued

Key takeaways

- Solana (SOL) has been knocked as being overvalued at its current price going by the value it returns to users.

- Solana supporters however say evaluating the token by “fee-based models” will not paint the true picture of the SOL reality.

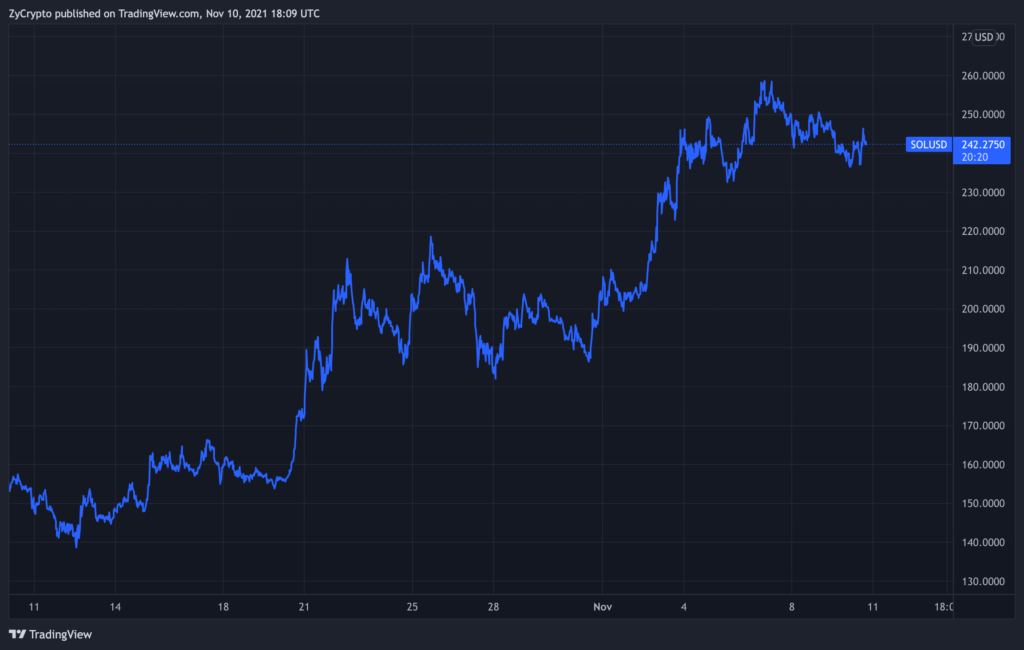

The Solana blockchain has thumped several groundbreaking accomplishments. This success has also been reflected in the price of its native token SOL which has added around 16,275% in gains year-to-date, However, recent controversies about the overall value of the crypto asset and the blockchain have arisen.

According to the Co-founder of UltraSoundFinance Chris [@usoundchris], SOL is “massively overvalued” if one takes a look at its P/E ratio. This metric fills for stock price per share divided by earnings per share and is used in traditional finance to give investors a sense of the value they get in return for their investment in a company. In the cryptocurrency world, the measure is used to measure the returns stakers make in decentralized exchanges.

Applying this measure to SOL, the analyst found that the cryptocurrency was highly overvalued as its P/E ratio was around 3,451.23x. He asserts that if Ethereum was that overpriced, it would be selling at $348,000 per Ether (ETH).

He goes on to explain the reason behind his assessment, stating that SOL is overvalued because the blockchain does not transfer “any of its revenue to its users,” adding that the network did not also show itself to have credible neutrality. He points to the fact that the network recently crashed and was able to coordinate over Discord to restart as reasons that he holds his stance, surmising that “SOL is not crypto.”

The critics’ stinging review of Solana is coming just after the blockchain network gained a distorted rep following the uncovering of more circulating coins than the blockchain’s developers disclosed in 2020. The discovery was made by the CEO of Cyber Capital, Justin Bons, who conducted a private audit via on-chain data. An additional 12 million coins were alleged to have been discovered to be in existence, hidden in an Automatic Market Maker (AMM) protocol.

The Solana team of developers however refuted the improper conduct at the time. They explained that the tokens were only used for market-making purposes and had previously stated plans to burn the tokens in a 30-day period.

The explanation has not passed without observation and acceptance. Responses to the scatting criticism of SOL show this. SOL proponents have stated that evaluating SOL by its P/E ratio would always result in it being overvalued, no matter the market price of the token.

CEO and CIO of 3ac, Zhu Su, chipped in saying that by using a “fee-based valuation model”, they would fail to understand why the market was the way it was. He warns that such models can cause conflation that would throw off investment strategies.

Source: Read Full Article