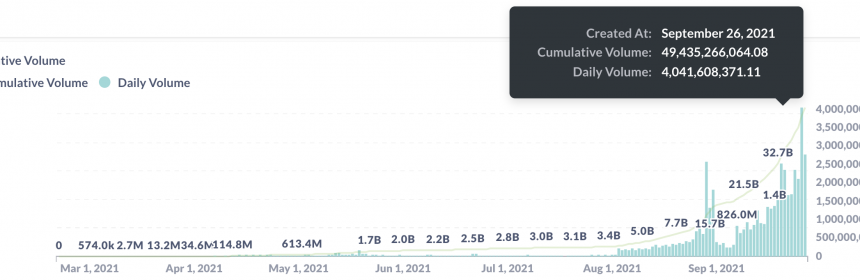

dYdX Overtakes Coinbase in Trading Volumes

The decentralized crypto exchange, dYdX, has overtaken Coinbase, America’s biggest crypto broker and exchange.

dYdX handled $4 billion in trading volumes on Sunday, $1 billion more than Coinbase handled in the past 24 hours.

dYdX is on course to surpass the centralized exchange today as well, handling $2.7 billion in trading volumes so far as pictured above.

Like Coinbase, dYdX also offers numerous trading pairs, like Sushi, Curve, Uniswap or AAve amongst others.

It also offers token rewards with traders receiving dydx in proportion to total volume for a fixed circa 4 million token distribution a month.

Currently only 55 million are circulating, with dydx just about crossing $22 earlier today.

Its volumes have ballooned in part because it has launched a zk based second layer that makes trading on the dex no different than on Coinbase.

Just as you need to make one onchain transaction to deposit to Coinbase, so too you make only one onchain transaction to go straight to the dydx second layer.

Thereafter, you don’t interact with the blockchain anyfurther. There are no onchain confirmations, nor do you even need to sign a transaction as the zk contract keeps account.

Instead your only interaction is with the UI where you can instantly open and close trades pretty much as you would on Coinbase.

Another thing that sets dydx apart is the wide range of perpetual contracts on offer, with some shown on the right.

That’s futures, but without an expiry day, with a 30x margin per contract.

Other centralized providers offer something similar, but it is usually limited to just bitcoin or eth.

On dydx instead you can 30x futures on Curve, betting on either long or short.

The only downside is that you need USDc to trade. You can’t deposit eth and then long or short either eth or something like bitcoin. Thus you can’t in a way doubly speculate as say on Deribit.

That might become available in the future, with the dydx governance token now able to vote on such matters and others as the trading platform goes dao.

Source: Read Full Article