Daniel Krawisz: Bitcoin and speculation

How to profit in Bitcoin?

While BTC has been shown to only be a “pump and dump,” Bitcoin SV is focused on utility. However, Bitcoin SV is a digital asset after all and therefore speculation is part of BSV, too.

We caught up with prolific Bitcoin thinker and speculator Daniel Krawisz to discuss in depth: speculating in Bitcoin.

Hi, Daniel! In our last interview, we touched lightly on the subject of speculation. I would like to hear more about your thoughts on speculating in and on Bitcoin, as well as in general. As of writing this, Bitcoin SV (BSV) trades at around $250, while BTC trades just under $60,000. We specifically invited you to explain this. So, why?

Winners in markets treat prices as conjectures about tradeoffs. Losers treat prices as genuine knowledge. The price of BTC is based on a trick which has been successful at making people act like losers.

BTC is a religion with a strategy for attracting converts and making its adherents more faithful. People in religions typically act like they know everything and claim to have absolute certainty when all they have are conjectures and an avoidance of objective testing. People in BTC are like this.

However, at some point the opportunity cost of holding BTC will become relevant. In Austrian economics, all costs are opportunity costs, so the cost of BTC is not owning productive assets like land or capital goods, not consuming something that is already produced, and not joining the BSV religion. The benefit of BTC is that other people might join the religion after you. The high price of BTC means that it is much better to expect more people to join your religion than it is to join other religions or to own land or consume.

Everyone in BTC is complicit in preventing each other from thinking clearly about what I have just written and from facing the true state of things. People are cognitively biased to believe things which cast them favorably. BTC appeals to people who want to tell themselves that they will be rich in the future without having to know or do anything.

On the other hand, BSV appeals to people who are sufficiently motivated by truth that they can accept that success is actually not likely on those terms. Therefore, the price of BSV is lower.

There are also illusions in BSV but they all keep the price down whereas BTC’s illusions all contribute to pumping the price. People in BSV correctly believe that success is uncertain, whereas people in BTC believe that success is certain. Illusions in BSV are understood to oppose success, therefore they contribute to a lower price.

There is an attempt to create an illusion about its true nature (BSV), just as there is with BTC, except that people are trying to make it look bad rather than good. This is easy to do because the true value of BSV is not understood very well even by people in BSV and is not discussed. We cannot dispel the illusion of BTC without dispelling our own illusions first. There is a lot we can do to make success more certain, but they will not happen without a successful inquiry into the true nature of things and accepting that we are worse off than we have believed.

Looking back at how BTC and BSV behaved price-wise in the past years, was there any way to have been able to tell this would occur the way it occurred now?

Every real-life situation is different and while it is usually possible to see a lot about the future from the information available at any given time, it is not easy to know what is relevant. New causes come to affect the world at every stage of history.

I have been surprised by how successful BTC has been at maintaining its illusion and how difficult it has been to communicate the value of BSV to other people. In particular, I have seen that people tend to act as if narratives are real whereas economics is not real, when really narratives are simply ideas and economics is something that nobody can escape from.

You should not feel bad if you did not make a lot of money off of BTC. Everyone in BTC is tricking each other into being very stupid. You can make money off of that but there is a lot of risk. If you had tried to make that money, you might just as well have lost a lot. With BTC, you never know if you are the greater fool.

Is there anything BSVers might have overlooked, overestimated or underestimated concerning speculating in the digital asset sphere?

As I have said above, people in BSV have accepted that self-deception is anti-success but have not managed to dispel all illusion. People who want illusion are repelled by BSV, and thus what has worked in the past to pump other coins does not work with BSV.

The most important thing to understand about speculation is that differential knowledge is what matters. Differential knowledge is what you know that other people don’t know. Thus, people who attempt to give you knowledge should be mistrusted because if what they had was real knowledge they would be giving away their own bread and butter.

Yet people in BSV act like they want to tell everybody about what they know and advertise all the wonderful projects that are being built. This is justly regarded with suspicion. If someone was really making a great project, he would want to keep it secret until it was all ready so that he could buy up coins at the lowest possible price. Anyone who is talking about what is being built on BSV should be suspected of bullshitting. Effort is required to gain information that is genuinely good. If people really wanted to pump BSV they’d all say that it is terrible and they think it’s going down and would keep all good information secret.

I think that the next most important thing to understand is the benefit of a long time horizon. Over longer times, fewer people are thinking. That makes a difficult game against alert players into an easy game against sleeping players. I have discussed this in “The Investor Hierarchy”.

I advocate trades that play out over several years.

People in BSV say that “price doesn’t matter.” That is silly and it sounds like BSVers have overlooked everything and know nothing. BSVers believe that they need to build, but, these markets do not act like anybody understands the true value of what is being bought and sold. That means that there is a lot of money to be made on knowledge alone.

I am not saying that people should not build. I am saying that understanding these markets is a greatly overlooked opportunity. What I would want is for people to understand how to speculate so well that they have no choice but to build. When people become more sophisticated with the market, the opportunities to make money by sitting around doing nothing will become rarer.

There is a paradox in what I am saying now, which is that I say you cannot trust people who try to teach you things and here I am telling you what is important. There is a fundamental problem with transmitting reliable information in Bitcoin. We could solve this problem if there were a protocol for attaching proof-of-work to arbitrary information. If you could easily verify that what I am saying had partially inverted hashes associated with it, then you know that I wasn’t trying to mess with you and that I was saying something I thought was really important.

What I have experienced from speculating in the digital asset sphere myself is that—at least for now!— it does not seem to be a successful way to bet on the basis of what the superior technology is, but rather on what the other speculators will do. This probably changes over the long term, as superior technologies will sooner or later draw the attention of the other speculators. What do you think?

That is correct. These markets are like a big poker game. In poker, you do not always show your cards by the end of the game. That means that the values of those cards does not always determine the outcome.

This market is a little different in that there is no end to the game. Thus, the value of your cards ultimately will matter but economics works very slowly so the game can go on a long time on pure bluff.

I have said in my video, Homo Bitcoinus, that Bitcoiners are a herd animal or like a flock of birds. The market is a flock of minds that all fly around a similar idea rather than a physical space. Your job as a speculator is to go where the herd will be and to bring forth consciousness. You must say what is on the tip of their tongue.

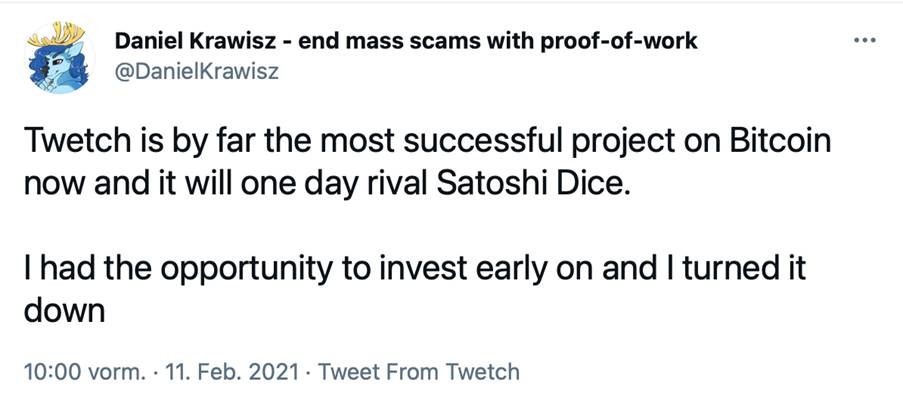

Why did you turn that opportunity down? What was it that you were not able to see back then?

I didn’t know how good they were going to be. To me, blockchain twitter was a demo that anyone would want to build just to make Bitcoin more valuable, so why would I invest in it? However, what they have really done is make the most fun and useful business currently operating on BSV.

However, I am doing well as a Twetch user, so it is ok.

In a private chat with me, you said, “People in BSV seem to believe in the quantity theory of money. (…) People need to learn the truth about the economics of money in order to correctly value Bitcoin.” Enlighten us.

The Fisher quantity theory, which is expressed in terms of the equation of state, implies that the value of money is the goods that are available in exchange for that money.

This theory suggests that we can improve the value of Bitcoin by increasing the transaction volume. People who think that transaction volume will drive up the price of Bitcoin are people who believe the Fisher quantity theory, even if they have never heard of it.

This theory is no good because it is present-oriented. All valuations are future-oriented. The goods that you can buy with money are, in fact, in competition with money. They are reasons to get rid of money, not reasons to hold money. Money does not become more scarce unless people want to hold it more. Therefore, holding money that drives up the price, not reasons to spend.

I tried to make this point a while back in BTC and people used it as an excuse to destroy all trade with small blocks. I did not understand that people would interpret what I said in this way. Really it is future goods that make money valuable, not present goods.

In fact, not all future goods make money valuable. Only goods that come as a surprise make money valuable. If you could know what goods were coming out and win, you would just buy stocks or bonds to sell before the new goods came out. Then you would earn income as you waited. It is because there will be goods that you don’t know about that you would want to hold money. If you have stocks or bonds when they come out, you might not be able to sell them in time or at a reasonable price.

As long as a good is in an uncertain future, it is a reason to hold money. As soon as it is in the present, it is a reason to spend money. We cannot get rid of commerce because then we get rid of future goods as well as present goods, obviously!

In any case, transaction volume is not the cause of value. Rather, value is the cause of transaction volume. What, then, is value? It is the present cause of future surprise goods, that is, the entrepreneurs. Thus the value of money is the other people, as I discussed above. It is not present goods. Not everyone is equally valuable because not everyone is as good at being an entrepreneur, but on the other hand you don’t really know who will do something especially good beforehand, so it is better to improve everybody.

Trying to drive up transaction volume does not necessarily do anything good unless you are a miner earning transaction fees. It does not mean that Bitcoin is going up. Of course, you would want to earn Bitcoin so you want to drive up transaction volume because of that but in that case you don’t care about transaction volume. You just care about what you earned. If you want to make Bitcoin go up, you should improve the other producers.

Of course, I do not claim absolute knowledge. Maybe my theory of money is wrong. This is a future prediction contest and all anyone has is conjectures about what is relevant to the future. We need to find the real truth regardless of what it is.

However, if I am right then we don’t all want to go around uselessly increasing transaction volume. (Of course, I have a mining pool so I DO want to do that, but not as a way to make Bitcoin go up.) What we want is to tell each other how to survive better so that we can all produce more for each other.

You also said, “When prices are incorrect, resources are wasted.” Can you break this down for us concerning Bitcoin? If we take the premise that BTC is overvalued, how exactly are resources wasted by that?

BTC is something that masquerades as money when it is not. People in BTC say that it is a “savings technology.” If BTC is overvalued, then people are giving up more to have savings in BTC than those savings will actually get them.

Savings are “money for a rainy day.” In other words, savings prepare you for times when there are big changes. When you have savings, you are first in line to take advantage of new information. That is not what BTC is good for at all. Quite the opposite: when people most need to spend, the chain will be congested and they will be unable to. BTC payment services like PayPal will be unavailable for whatever reason.

The resources that are being wasted are people’s time, both present and future. They are losing time working to buy BTC and they are losing their future when they have fake savings that they think are real.

And if we take the premise that BSV is undervalued, how exactly are resources wasted by that?

BSV is the real savings technology. If it is undervalued, people are undervaluing preparing for uncertain futures. Other monies are scams that are not good for savings.

When people save, they forego present consumption for the future. They become more willing to take advantage of opportunity. Thus, people produce fewer consumer goods and more capital goods when they save more. This leads to a more productive economy in the future.

Resources that are being wasted when people don’t understand the need to save are goods that could be used to prepare for the future but which are instead being consumed.

I have written about this in, “Savings and Civilization”.

What does “prices are incorrect” really mean? How to tell if a price is correct or incorrect? Can we tell by solely observing the fact that resources are wasted that prices have to be incorrect?

As I said at the start of this interview, prices are conjectures about tradeoffs. If prices are incorrect, then society makes bad choices. You cannot observe that resources are being wasted because waste occurs by making a worse choice when you could have made a better choice. Remember, all costs are opportunity costs. The better choice does not happen; therefore, you cannot observe it. You must know that it was available in order to recognize waste.

The way to know if a price is correct or incorrect is to understand the true nature of the trade-off. In particular, knowledge in markets is always relative because you need to be ahead of other people in order to be successful. Thus, you need to know what is not understood by other people about the trade-off.

Let us say that a plot of land is available for a certain price. In order to evaluate this price, you must know all benefits that could be obtained from owning the land and compare it to all benefits that could be had from keeping the money. The land could benefit you by being productive so that it earns income or provides you with food. It could also be a beautiful place to live. On the other hand, if you keep the money, you may be able to take advantage of a better opportunity that may show up later which would not be available had you bought the land.

The Austrian theory of money is that the value of money has to do with being first in line to take advantage of new opportunities. Thus, even though money is not a productive asset you still need to have some in your portfolio or else you lose from avoiding new opportunities.

Thanks, Daniel!

Source: Read Full Article