Charlie Munger likens cryptocurrency to 'venereal disease'

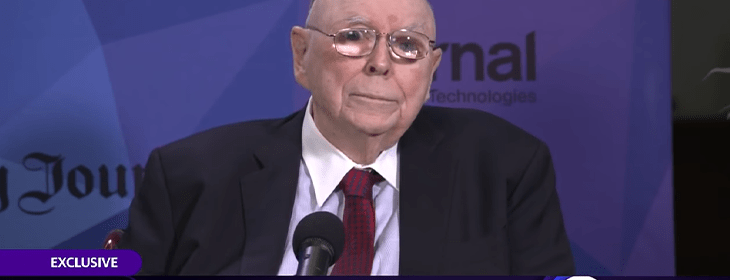

Charlie Munger is best-known as a legendary value investor and vice chairman of Berkshire Hathaway (NYSE: BRK.A). At 98 years old, Munger is worth approximately $2.4 billion, so most people listen when he speaks on investment.

While discussing inflation, speculation, and other related topics this week, Munger said he was proud that he had never invested in BTC or other cryptocurrency and likened them to venereal disease. That’s a strong statement, and it grabbed headlines around the world.

Why is Charlie Munger such a big BTC critic?

Both Warren Buffet and Munger have maintained that BTC is essentially worthless for years. Buffet famously called it “rat poison squared,” and Munger has consistently expressed skepticism about the value of any cryptocurrencies.

In his latest interview, Munger made several impactful statements against so-called ‘cryptocurrencies.’

- He said cryptocurrency traders want to get rich quickly without doing any actual work.

- He stated that no civilized government would want cryptocurrencies to mix with the current payment systems.

- He outright called for cryptocurrencies to be banned. He said this should have happened much earlier.

- He likened cryptocurrencies to venereal disease. That’s a graphic depiction for sure.

- He also likened BTC to a bad genie that had been let out of the bottle. “God knows what happens” was his only prediction for what will happen in the future.

Why the hostility towards cryptocurrencies such as BTC? Some would argue that Buffet and Munger are too old to get it and have missed several important technological revolutions, including the Dot Com giants like Amazon and the Big Tech companies like Facebook and Google.

Perhaps there’s some truth in that, but there’s also a lot of truth in Munger’s characterization of cryptocurrency trading and the currencies in general. 99.9% of them provide no extra value to society and are used for nothing other than speculation. A quick scroll through Twitter will confirm that many traders are only interested in quick gains with no regard for the people they’re plugging these ‘investments’ to nor the long-term viability of the cryptocurrencies themselves.

Of course, rather than engaging in logical debate and trying to refute Munger’s points like rational adults, many BTC fanatics took to social media to engage in the usual ad hominem attacks.

Here we have a promoter of Cardano, a system that has created zero value whatsoever since its release, attacking Munger rather than attempting to refute his points.

It’s time for utility and value creation to shine

Munger is essentially right about the current state of the digital currency industry. However, like many who aren’t focused on the industry full-time, he’s making the mistake of throwing the baby out with the bathwater. This isn’t his fault since BTC maximalists and others such as those behind Monero have done a lot to promote lies about the nature of the industry and to cash in on naive investors who believe in “HODL” and other memes they promote. Munger’s views are an unfortunate consequence of over a decade of misinformation and lies.

Yet, once all of this is washed away by the regulatory tide that is fast approaching, there will be a chance for real utility and value creation to shine. Micropayments could change how we pay for services online, peer-to-peer transactions will eliminate many middlemen who make small, casual transactions impossible, micro-lending may help people in developing nations get access to capital and build reputation, and censorship of legitimate, legal information will be rendered virtually impossible.

There’s plenty of value in Bitcoin. It’s just that it has been so badly misrepresented by people who actively sabotage it in the hopes that others won’t understand its power that even the best investors in the world have failed to see its true value. However, slowly but surely, the tide is turning, and soon the world will learn what the Bitcoin protocol is capable of, and about the real value creation it can facilitate. Charlie Munger may not be around to see it play out, but Bitcoin (BSV) can be a great asset to capitalism, property rights, and economic efficiency. There’s so much value yet to be unlocked that it boggles the mind.

Watch: CoinGeek New York presentation, BSV Blockchain: It’s About Time

Source: Read Full Article