Bitcoin Price Analysis: BTC Eyes Upside Break above $65K

Bitcoin price is gaining pace above $60,000 against the US Dollar. BTC remains supported on the downside near the $62,000 and $60,000 levels.

Bitcoin Price Analysis

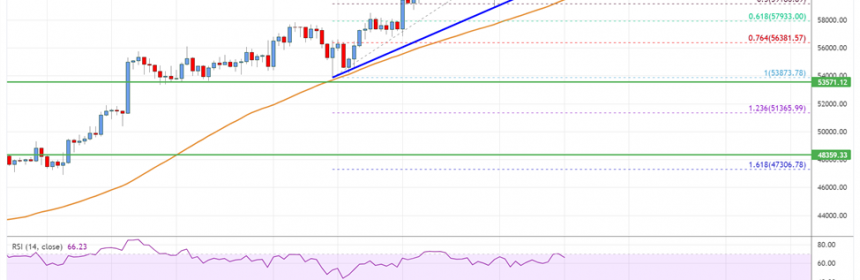

Bitcoin price formed a base above the $55,000 level. As a result, BTC started a fresh increase above the $58,000 and $60,000 resistance levels.

The price gained pace for a move above the $62,000 level and the 55 simple moving average (4-hours). There was also a close above the $62,000 level and the 55 simple moving average (4-hours). The price traded as high as $64,500, and it is now consolidating gains.

There was a break below the $64,000 level. Bitcoin could soon test the 23.6% Fib retracement level of the upward move from the $53,873 swing low to $64,500 high.

An immediate support on the downside is near the $63,000 level. There is also a key bullish trend line forming with support near $62,200 on the 4-hours chart of the BTC/USD pair. The next key support is near the $60,000 level. The 55 SMA is also positioned near the $59,200 level to act as a strong support.

It is near the 50% Fib retracement level of the upward move from the $53,873 swing low to $64,500 high. If the price fails to stay above $59,200, it could revisit the $55,000 support zone.

On the upside, an initial resistance is near the $54,250 level. The main resistance is forming near the $65,000 zone. A close above the $65,000 zone is needed for a fresh increase. In the stated case, the price is likely to rise steadily towards the $70,000 level.

Bitcoin Price

Looking at the chart, bitcoin price is clearly trading above $62,000 and the 55 simple moving average (4-hours). Overall, the price is showing positive signs and it could continue to rise above the $65,000 level.

Technical indicators

4 hours MACD – The MACD is now gaining momentum in the bullish zone.

4 hours RSI (Relative Strength Index) – The RSI is well above the 50 level.

Key Support Levels – $62,000 and $60,000.

Key Resistance Levels – $64,500, $65,000 and $68,000.

Source: Read Full Article