Bitcoin Miners Transfer Large Amount To Exchanges, Sign Of Selling?

On-chain data shows that Bitcoin miners have transferred many coins to exchanges today, which may be a sign of selling.

Bitcoin Miner To Exchange Flow Has Observed A Huge Spike Today

As pointed out by an analyst in a CryptoQuant post, a total of 1,637 BTC was deposited to exchanges by the miners today. There are a couple of relevant indicators here. The first is the “miner reserve,” which measures the total amount of Bitcoin currently sitting inside all miners’ wallets.

The other metric of interest is the “miner to exchange flow,” which tells us about the total number of coins miners (all or belonging to a specific mining pool) transfer to an exchange or a group of exchanges.

When this metric’s value spikes, miners deposit many coins to the exchange. This trend may have bearish consequences for the price as miners usually transfer their coins from their reserves and into exchanges for selling purposes.

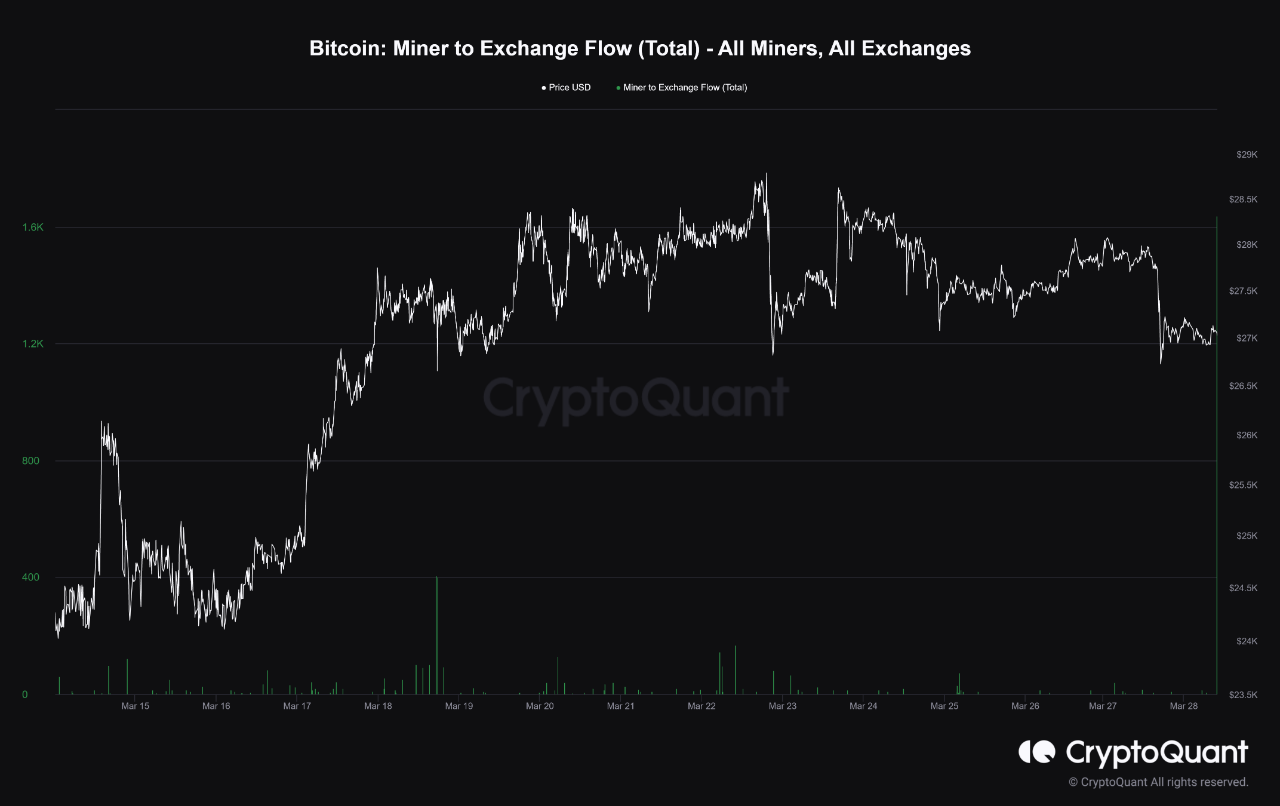

Now, here is a chart that shows the trend in the Bitcoin miner-to-exchange flow, for all miners and all exchanges:

Looks like the value of the indicator has spiked in the last few hours | Source: CryptoQuant

The above graph shows that the Bitcoin miner-to-exchange flow has observed a huge spike in the past day. With this large movement, miners have deposited 1,637 BTC (roughly $44.2 million at the current price) to exchanges.

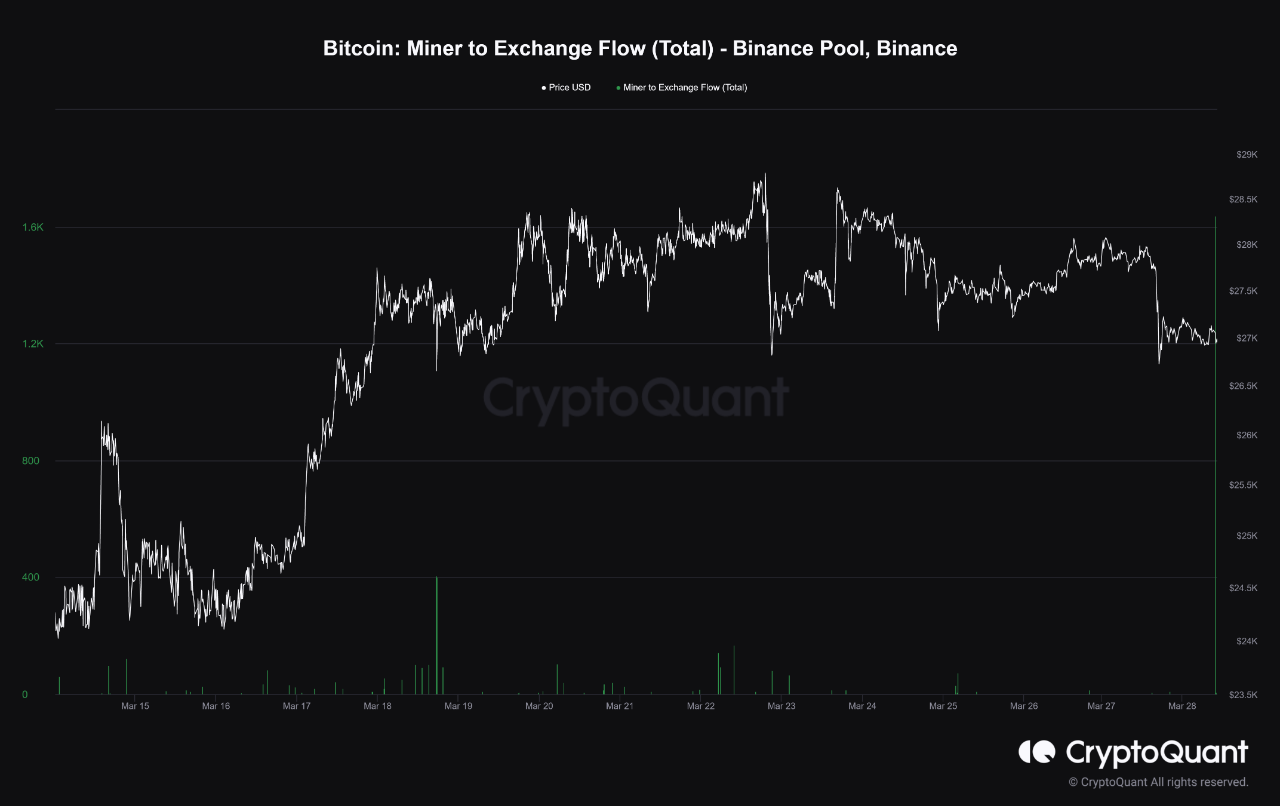

The quant has also found out that the Binance mining pool, in particular, was responsible for this exchange inflow. The destination of these coins was also to a single exchange: Binance. The below chart shows this movement.

The entities involved in today’s miner exchange inflow | Source: CryptoQuant

Usually, deposits like these are a sign of increased selling pressure from the miners and, thus, can lead to a decline in the price of the asset, at least in the short term.

In the present case, if these inflows were indeed made with selling in mind, then it would mean that miners possibly think that the rally is winding off for now as the asset’s price has taken a hit during the past day, so they are striking while the profit-taking opportunity is partially still there.

Data of the Bitcoin miner reserve, however, shows an interesting picture.

The value of the metric seems to have been moving sideways in the last couple of weeks | Source: CryptoQuant

The chart shows that the Bitcoin miner reserve saw a sharp upwards spike just before the plunge due to today’s transfer to Binance. Curiously, this increase in the reserve was just enough to cancel the movement to the exchange.

This means that even though a large withdrawal from the reserve may have occurred today, the miner reserve has only moved sideways since the miners only took out what was freshly deposited into their wallets.

BTC Price

At the time of writing, Bitcoin is trading around $26,900, up 4% in the last week.

Source: Read Full Article