Are DeFi Tokens Worth Buying in 2021? Experts Speak on the Defi Landscape

Even though we are only a week in, 2021 has started off with a bang for the crypto world.

Amid political chaos in the United States, crypto prices have risen significantly so far this year. Bitcoin started 2021 around $29,000; at press time, the price of BTC was up to $39,700 and appeared to be on the way to $40,000.

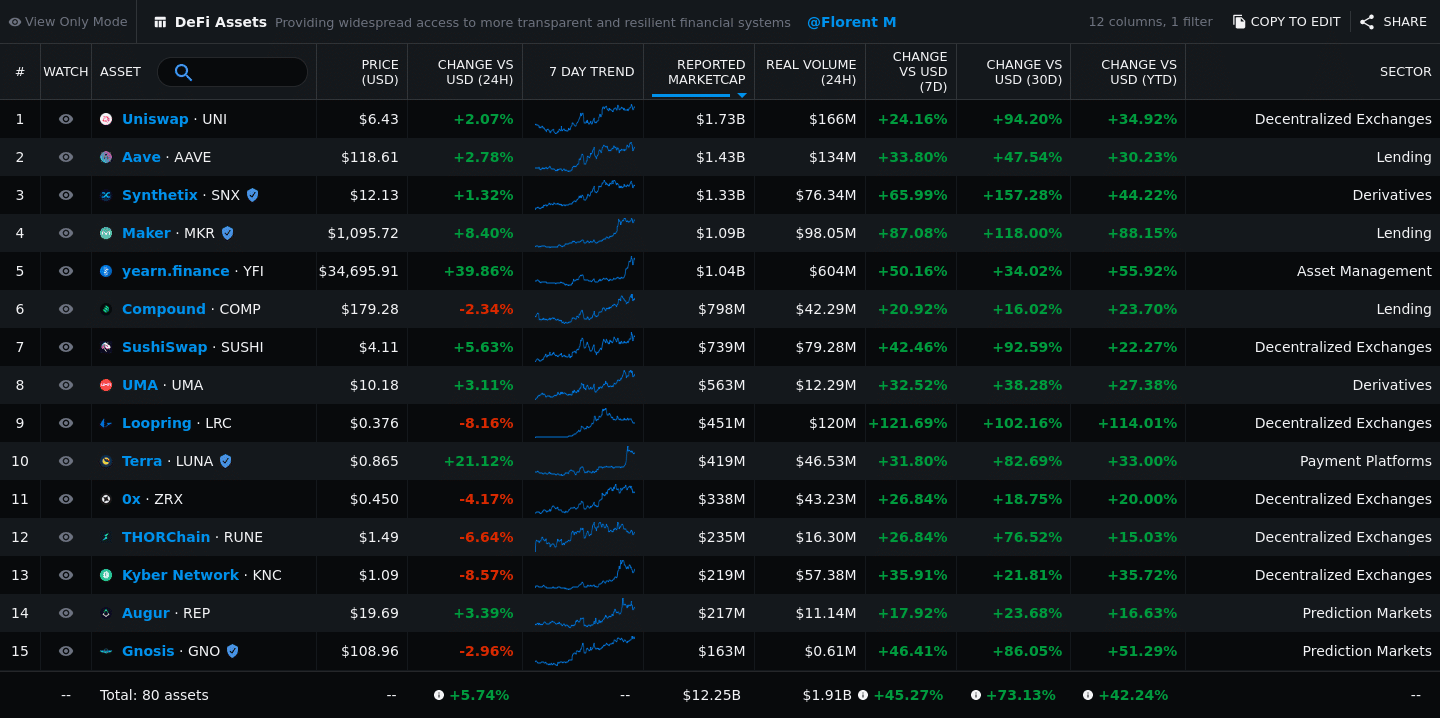

But, it is not all about Bitcoin, beyond BTC, there has been an explosion in coin prices across the board, particularly in the DeFi space. At press time, at least 44 of 70 DeFi assets listed on coin market data site, Messari showed positive trends over the last 30 days; 62 of them showed positive trends over the last seven days. In both categories, the top asset showed growth of over 150% during their respective time periods.

Of course, seeing such explosive figures is somewhat reminiscent of the crazy price action of 2020’s DeFi summer. Similar to now, token prices were up across the board. However, the rally came to a halt in the autumn, when market corrections brought prices back down to earth.

Still, a number of analysts within the crypto space seem to believe that we ain’t seen nothin’ yet. James Wo, Founder of Digital Finance Group (DFG), told Finance Magnates that “though DeFi experienced an incredible spike in 2020, this is only the beginning.”

DeFi Will Continue to Grow as More Features and Services Are Presented to End-Users

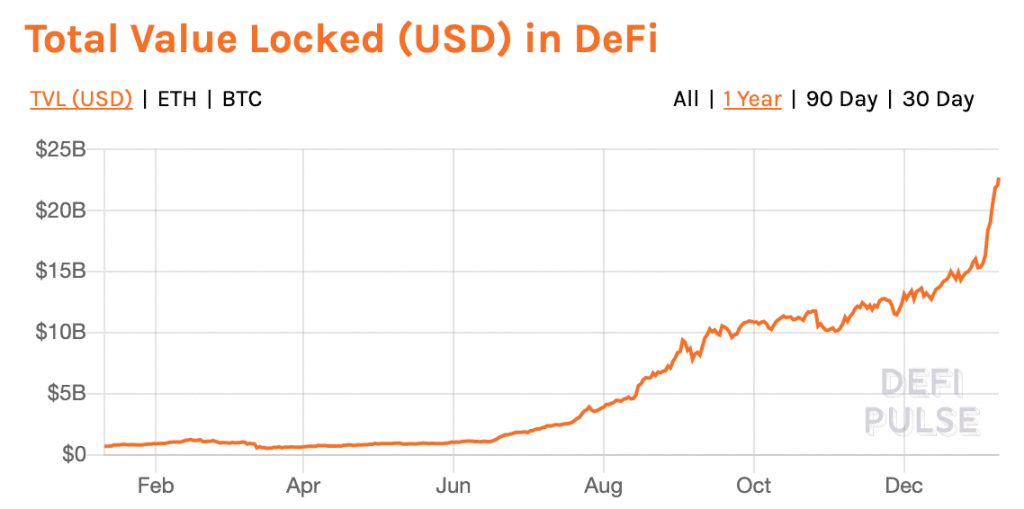

Indeed, the ‘Total Value Locked’ (TVL, or the amount of money that’s been put into the DeFi ecosystem) has significantly increased this year. Earlier this week, OKCoin communications lead, Will McCormick told Finance Magnates that for example, “Ethereum is certainly being utilized more as a network. TVL in Defi protocols built on Ethereum has jumped 350%, from $4B to more than $18B in 2021 alone.”

However, a 350% increase in TVL in the DeFi ecosystem does not necessarily correlate to a 350% increase in the number of users within the DeFi ecosystem.

However, Wo believes that the possible discrepancy between TVL growth and user growth will be short-lived: “DeFi will only continue to grow as new features are added, such as trading NFTs and other financial instruments that may not have high liquidity in traditional finance,” he said.

“Protocol governance systems will continue to improve with the implementation of more advanced participation options, such as proxy voting,” he said.

“We will also see the incorporation of more features from traditional finance, like fixed-rate lending, in addition to the development of new features not possible in existing centralized financial systems.”

Measuring the DeFi World: TVL vs. the Number of Unique Users

Of course, there has already been evidence of growth in the number of DeFi users. However, Do Kwon, Co-Founder, and CEO of Terraform Labs (TFL), the group behind Terra, explained to Finance Magnates that determining exactly how many unique individuals have entered the DeFi space has its difficulties.

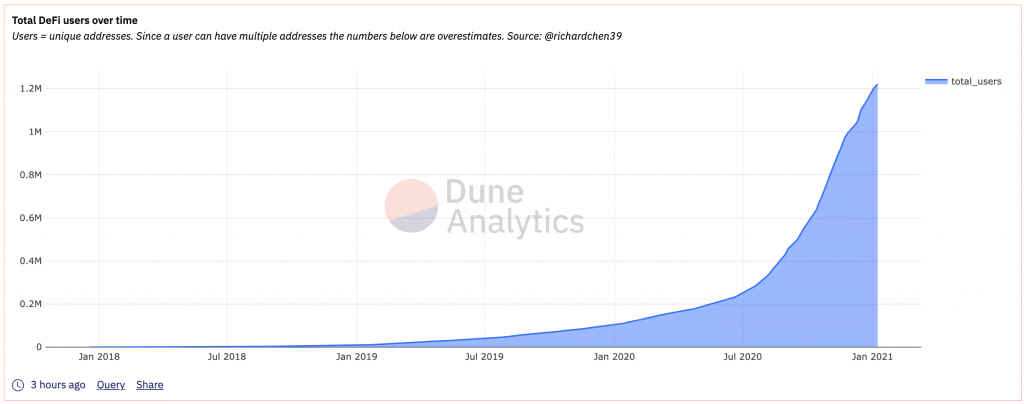

One way to estimate the number of users within the DeFi space is to look at the number of unique DeFi addresses.

At the beginning of 2020, data from Dune Analytics showed that there were roughly 103,500 unique DeFi addresses. By December of 2020, that figure had surpassed 1 million. At press time, there were over 1.22 million unique DeFi addresses.

Indeed, the number of addresses, along with the amount of TVL, has grown significantly in the past several months. “The growth has been parabolic since the ‘DeFi Summer’ of 2020,” Kwon explained to Finance Magnates.

Still, “there are some notable caveats with the [unique DeFi addresses] metric and how it is applied to TVL,” he added.

“For example, whales who hold large sums of crypto assets tend to be the biggest liquidity providers to lending protocols like Maker and DEXs like Uniswap to accrue fees, yield, and LP tokens,” he said. In other words, a small number of these unique addresses may be responsible for the lion’s share of activity, and capital, in DeFi.

“The Numbers and Pace of Adoption Speak for Themselves.”

Beyond this, there may be an even smaller group of individuals or individual entities that control multiple addresses within the DeFi ecosystem. “Additionally, many DeFi users, particularly larger whales, utilize multiple addresses for privacy, efficiency, deployment of capital, and (in the case of developers) deployment of code,” Kwon went on.

Beyond that, “many yield farmers also opt to use multiple addresses for protocols like Uniswap and 1Inch Exchange hoping to score a big payday when the platform unlocks retroactive airdrops to specific users,” he said. After all, this is “something both Uniswap (UNI) and 1Inch Exchange (1INCH) did” in the past.

However, the growth in the amount of capital locked in the DeFi ecosystem has increased at such an astounding rate that an influx of new unique users seems nearly undeniable.

“Regardless, TVL for DeFi recently climbed over $20 billion, up from $690 million from January 2020 – a larger than 20X fold increase,” Kwon said. “The numbers and pace of adoption speak for themselves.”

“DeFi’s Adoption Is Poised to Accelerate This Year.”

And, like Wo, Do Kwon believes that as new features and services are added into DeFi this year, both the number of unique users and TVL are preparing for an explosion, and, possibly, token prices along with them.

“DeFi’s adoption is poised to accelerate this year,” Kwon said to Finance Magnates.

Indeed, while some have drawn comparisons between DeFi’s growth and the ICO bubble that took place at the end of 2017, Kwon believes that the DeFi projects of today have the substance to back their increased token prices.

“The user-experience for DeFi, while still lacking in many areas (i.e., gas fees, slow confirmation times, etc.), is vastly improved from where crypto was during the 2017 bull run,” he said.

“DeFi protocols are also much more accessible than traditional financial services, which are inaccessible to over 1.7 billion people in the world, even though two-thirds of them have mobile phones,” Kwon continued. “That’s a massive pool of potential users.”

Indeed, “demographically speaking, DeFi users typically hail from developed nations like the US, European countries, China and major SE Asian technological/financial sectors like Singapore, South Korea and Japan.”

Expansion of the DeFi User Base in 2021

Now, though, Kwon believes that this set of users is “expanding,” particularly as more DeFi services are created to serve populations comprised of financially underserved individuals.

“For example, synthetic assets and stablecoins empower financial disenfranchised users to access equity markets (such as US tech stocks) and global avenues of exchange that were previously unavailable to them,” he said.

“These users can be from Southeast Asia, where excessive fees and tax structures may prohibit accessing US markets, or Venezuela, where stablecoins help circumvent capital controls and censorship that preclude access to foreign currencies and markets.”

Other services that DeFi platforms provide could become increasingly popular amongst groups that have been economically affected by the COVID-19 pandemic.

“Low-volatility savings rates from DeFi protocols (e.g., Anchor) may even help small businesses and retail users stay afloat in economic turmoil with yields that vastly outpace traditional bank savings,” Kwon pointed out.

“Many of the future demographic for DeFi don’t even have savings vehicles, and instead, are fully exposed to the inflationary whims of government-issued fiat currency.”

The Rise of Proof-of-Stake

Additionally, Tim Ogilvie, Chief Executive of Staked, sees the growing popularity of yield-generating practices like staking as a catalyst for DeFi growth throughout the year 2021.

“2020 was the year proof-of-staking came of age, and this year will see these blockchains start to dominate,” he said. “Staking” is the practice of locking a certain amount of tokens into a protocol in order to earn financial rewards as a transaction validator. This is only possible on networks that run on Proof-of-Stake algorithms.

Indeed, while Proof-of-Work algorithms arguably dominate the crypto scene at this present moment, “four of the top nine crypto assets by market cap are now well on a path to Proof-of-stake,” Ogilvie pointed out. This is particularly significant “compared to a year ago when the number was zero,” he said.

At this point, “Proof-of-Stake already represents roughly 15% of the total crypto market cap, and its dominance in developer engagement, including Ethereum as well as Polkadot, Cardano, NEAR, Solana and others, will grow in 2021,” Ogilvie continued, adding that “this will trigger an avalanche of user-facing projects and apps.”

”The Decentralized Economy Will Continue in 2021 to Migrate to Proof-of-Stake.”

What does the staking landscape look like at this present moment? “Polkadot, currently the largest PoS chain, has over $3 billion staked and Ethereum 2.0 is already above $2 billion after going live only a few weeks ago,” Ogilvie said.

“Chainlink, the fifth-largest crypto asset by market cap, has announced that it also plans to shift to PoS, and there will be others. By the end of 2021, most of the top chains will have moved to various degrees of staking systems,” he continued.

“With staking, users will always be able to receive a better return than simply holding an asset. Plus, when an asset is appreciating and you also have staking rewards on that asset, then you are double-compounding your gains.”

“The various Bitcoin bridges coming to market are in response to the fact that the huge wealth held in bitcoin is eager for new ways to put that wealth to use and make returns on PoS blockchains. All this means that the decentralized economy will continue in 2021 to migrate to proof-of-stake.”

The Continuing Role of BTC and ETH

Just as the price of the two largest crypto assets, Bitcoin and Ethereum, currently seem to have big effects on token prices in the DeFi space, the growth of the DeFi ecosystem could increase the power of the opposite effect.

Do Kwon explained that “the ETH and BTC prices are broadly reflections of capital flows in crypto markets.”

“For example, Grayscale’s investment trust ballooning shows billions of capital inflows to Bitcoin,” he explained. “But, that may change too as institutional adoption of Ethereum picks up, the CME adds ETH futures, and other factors increase capital flows to Ethereum relative to Bitcoin.”

“More granularly, ETH and BTC affect DeFi in some subtle ways. For example, ETH and wrapped Bitcoin (WBTC – ‘Bitcoin on Ethereum’) are used as collateral in several lending and money market protocols.”

“Users can also cross-margin positions on centralized exchanges using Bitcoin or ETH, buy on-chain options for WBTC with ETH as the underlying collateral, and more,” Kwon explained. “These have tangible effects on capital efficiency, margin requirements, and other metrics that impact traders and regular DeFi users.”

As time goes on, the effects of ETH and BTC on the DeFi ecosystem may extend beyond the financial world: “ETH and BTC prices will likely have numerous effects extending across narratives, DeFi primitives and community sentiment (e.g., tribalism) – not just DeFI token prices,” Kwon said.

What are your thoughts on DeFi in the year ahead? Let us know in the comments below.

Source: Read Full Article