An offer for profit-seeking exchanges

This post originally appeared on the Unbounded Capital website and we republished with permission from Dave Mullen-Muhr.

While it has been known in the two years since BSV was “delisted” from multiple exchanges under the guise of protecting exchange customers from an insecure network, the claim of BSV’s alleged insecurity has recently been brought back to our attention from new entrants into the cryptocurrency space. Multiple people we are speaking to are confused as to why there is such a delta between how Unbounded Capital sees Bitcoin’s (BSV) security and how exchanges like Binance and Coinbase see Bitcoin’s security. At Unbounded Capital we understand Bitcoin to be incredibly secure with effective settlement of transactions nearly instant (as fast as communication channels can send the packets of data across the internet), while the aforementioned exchanges imply, or explicitly claim, that Bitcoin is so insecure that they required comically long 1008 confirmations to recognize transactions as settled. This is allegedly in the name of protecting themselves and their customers against 51% attacks and reorgs, among additional vague and non-quantifiable criteria.

It seems clear to us that this is an excuse on the part of the exchanges which, instead of delisting BSV in the interest of customers, have actually delisted BSV due to political reasons. However, in case we are mistaken, and in light of the fact that Coinbase has recently become publicly traded, we thought that new equity holders in particular would like to hear an offer for insurance. Insurance could protect against what Coinbase management suggests is a major risk, so major that it is preventing them from supporting Bitcoin (BSV) altogether, an asset and network with significant demand for trading and one that we think will be foundational to the future of the internet. At Unbounded Capital, we are not in the insurance business but we have relationships with many firms which may be interested in offering this product for BSV. At Unbounded Capital, our interest includes driving adoption of the businesses building on top of Bitcoin and expanding access to BSV the asset through user friendly on-ramps like Coinbase is something we would be happy to facilitate. Below is a framework for an insurance offering that we think our partners would find acceptable.

A framework for insuring BSV

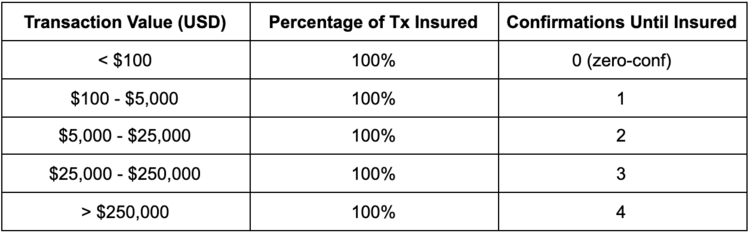

This framework is what we anticipate being a reasonable starting point for a negotiation. We welcome any exchange that has delisted BSV due to concerns over its insecurity to reach out to begin actual discussions and we will offer assistance in finding a willing party to underwrite a similar offer. The starting offer is to ensure 100% of the value for all BSV transactions which cause customers to experience loss of funds due to BSV blockchain reorgs. The goal is to cover 100% of exchange customers for only $1,000 USD/month/exchange. Transactions could be tiered based on their USD value, with small payments presenting virtually zero risk but large payments, logically, presenting a higher expected value of risk, although still miniscule. The breakdown might look something like this:

Completely insuring BSV transactions with potential values in the tens or hundreds of millions of dollars in as quick as 4 confirmations is a major improvement for Coinbase customers since Coinbase’s internal risk assessment apparently suggested they require 1008 confirmations for transactions as small as $1 (when they briefly supported the asset prior to delisting)!

Our suspicion is that we will see zero interest from exchanges which have provided bogus reasons for their delisting of BSV to hide their real motivations which were almost certainly political in nature. However, it’s one thing for us to suggest their public misrepresentation, but actions speak louder than words. At Unbounded Capital we would like to make our network and resources available to help exchanges protect against what they see as a major security risk.

If our suspicion is wrong and the exchanges gave earnest reasons for their delisting, we should see significant interest in our offer as available revenue from BSV trading far exceeds this minuscule $1000 monthly payment, especially given the fantastic terms outlined in our framework, which could extend complete coverage to all exchange customers. We even think it would be reasonable to consider insuring all zero-conf transactions valued under $100 USD for free as a way of establishing the relationship between the insurer and the exchanges should any exchange deem the $1000 monthly premium too high a cost to justify. We think this is an incredible offer for any profit seeking business!

If our suspicion is right and exchanges are playing politics and providing bogus reasons, we will be glad to have something to point to during discussion with future entrants to the cryptocurrency space who are confused by the fact that exchanges claim BSV is insecure despite lacking empirical evidence to suggest this (and having significant evidence to the contrary).

If you own and/or operate an exchange (including new owners of COIN) please reach out to us and/or your company’s management to continue the discussion!

Source: Read Full Article