Abendum auditing software joins Norwegian regulatory sandbox

In March 2021, the Financial Supervisory Authority of Norway (Finanstilsynet) selected Abendum as the single participant in its regulatory sandbox. Now, the final report is available. You can read it here.

The purpose of the regulatory sandbox & Abendum’s software

Like many regulators trying to understand blockchain technology and FinTech development, the Financial Supervisory Authority of Norway created the sandbox so it could learn more about FinTech innovation while giving participants a chance to learn more about regulations and contribute to increased financial innovation.

In March 2021, Abendum was selected as the single participant in the regulatory sandbox. Abendum’s software aims to make it easier for auditors to collect sufficient and appropriate audit evidence. In turn, this will make it easier for auditors to comply with regulations such as The Auditors Act.

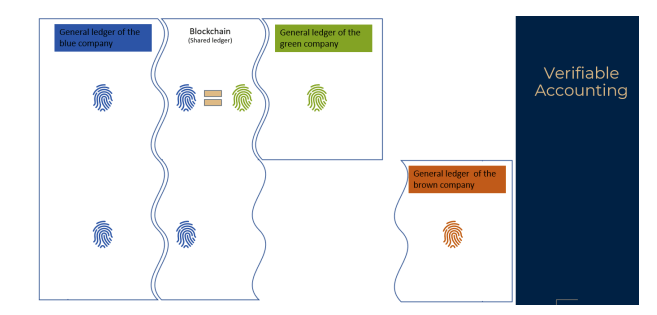

What exactly does Abendum’s proof-of-concept software do? It takes a hash (fingerprint) of each posting on a ledger and stores it on the blockchain. Each fingerprint is unique and can be checked against a partner’s fingerprint.

According to the Financial Supervisory Authority of Norway, one of its reasons for selecting Abendum’s software was to assess the quality of the evidence it can achieve.

Why put auditing evidence on the blockchain?

According to the section of the report titled “The value of putting audit evidence on the blockchain,” there are several key benefits:

- The use of blockchain technology may streamline an auditor’s work by automating the collection of evidence.

- The blockchain, being an immutable global ledger, can strengthen the integrity and availability of audit evidence.

- The software will take a fingerprint of the general ledger postings and log these against the blockchain in an ongoing way. This will happen automatically.

- The solution will protect privacy. Even if the fingerprint is placed on the open blockchain, it will not be possible to read confidential information. The accounting data is encrypted.

- Abendum uses the BSV blockchain. It’s globally available, public, and scalable.

Objectives of the sandbox and its execution

The specific goals of participation in the sandbox were to answer questions about:

- ISAs 500, 505, and 402, including key parts of the Auditors Act.

- Documentation requirements for auditors in accordance with ISA 230.

- Testing the solution. This involved both auditors and accountants.

- The Anti-Money Laundering Act and blockchain technology.

As for the execution, it involved five sessions of three hours each. These were carried out between May and November of 2021. A pilot project was also carried out by auditors and accounts who provided feedback.

How did it go? A detailed breakdown of each criterion outlined above and how Abendum performed can be found in section three of the full report here.

After the sandbox and the feedback from all involved, Abendum feels its plans to scale up, seek additional financing, and develop a commercial tool have been strengthened.

Watch: CoinGeek New York panel, Investing in Blockchain Ventures

Source: Read Full Article