The Castle Story…

Shares of diagnostics company Castle Biosciences Inc. (CSTL) are down more than 70% from their 52-week high of $78.92, recorded last June, and trade around $22.

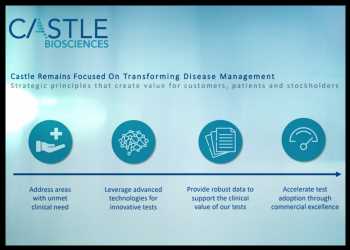

The company’s current portfolio consists of tests for skin cancers, uveal melanoma, Barrett’s esophagus and mental health conditions. DecisionDx-Melanoma, DecisionDx-SCC, DecisionDx-UM are some of the test offerings. A couple of research and development programs for tests in other diseases with high clinical needs are also underway.

In 2021, the company completed two important acquisitions, adding myPath Melanoma test and TissueCypher Barrett’s Esophagus test to its portfolio. In April of this year, the company acquired AltheaDx, adding IDgenetix to its portfolio of innovative tests.

Thanks to the company’s expanding test offerings, revenue has increased dramatically over the years.

Net revenue was $13.75 million in 2017; $22.78 million in 2018; $51.86 million in 2019; $62.65 million in 2020; and $94 million in 2021.

According to Castle Biosciences, 2021 was a year of growth across its business, with 50% revenue growth.

The company reported financial results for the first quarter ended March 31, 2022, last month.

Net loss for the first quarter of 2022 widened to $24.6 million or $0.97 per share from $4.3 million or $0.17 per share for the same period in 2021. Revenues were $26.9 million in Q1, 2022, an 18% increase compared to $22.8 million during the same period in 2021.

Looking ahead to full-year 2022, Castle Biosciences expects revenue in the range of $118 million to $123 million, implying a growth of 26% to 31% over 2021.

Cash position:

As of March 31, 2022, the company’s cash and cash equivalents totaled $309 million.

At the ASCO…

The company will be sharing data demonstrating DecisionDx-Melanoma’s ability to risk-stratify patients according to melanoma-specific survival at the ASCO Annual Meeting, being held June 3-7.

Castle Biosciences began trading on the Nasdaq Global Market on July 25, 2019, priced at $16 each. The stock has traded in a range of $17.01 to $78.92 in the last 1 year.

CSTL closed Tuesday’s trading at $22.27, down 1.81%.

Source: Read Full Article