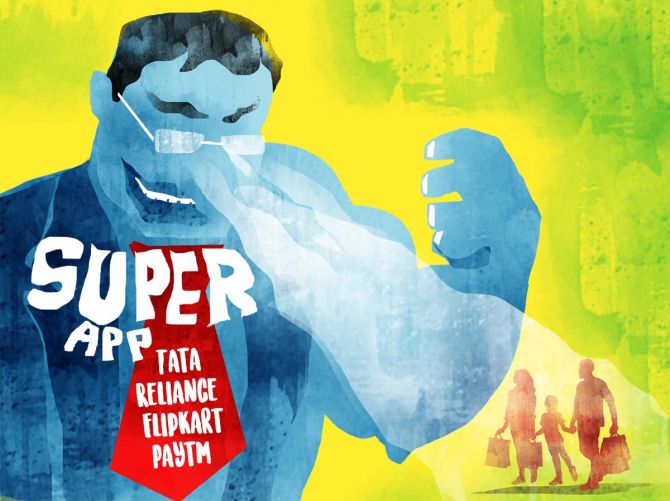

Tatas, Adani, Ambanis in scramble for super app

The groups plan to take on well-entrenched players like Amazon, Flipkart, and Paytm by merging their offline businesses with e-commerce initiatives.

India’s top business groups, such as Tata, Adani, and Reliance Industries, are scouting for acquisition targets to offer additional goods and services under their “super app” umbrella.

The conglomerates are planning to offer personal loans, travel bookings, and movie tickets to create a consolidated digital platform that will support their existing offline businesses, say bankers.

The groups plan to take on well-entrenched players like Amazon, Flipkart, and Paytm by merging their offline businesses with e-commerce initiatives.

“Tata, Adani, and RIL have millions of customers across their verticals. The super app will just bring them under one umbrella and help cross-sell products,” said a banker close to the development. “They are looking for those digital companies that are not in their current portfolio and offer a ready customer base,” the banker said.

The Adani group is the latest to join the bandwagon by acquiring a minority stake in travel portal, Cleartrip, from Walmart-backed Flipkart group. Like Tata and RIL, the Adani super app will support its offline businesses. The group had in September acquired a 10 per cent stake in CSC Grameen eStore, a rural-focused grocery store, to offer its range of food products, including Fortune oil, to rural customers, say bankers. The group aims to add 1 billion customers to its digital platform by 2030.

The Tata group, which recently bought several e-commerce companies, is also on the prowl. Tata Digital, which plans to launch TataNeu super app, will offer all goods and services from the Tata group companies, including airline and hotel bookings. The recently acquired e-commerce companies by the group, including BigBasket and pharmaceutical product delivery firm 1MG, have been integrated into the super app.

The Tata group employees have been currently given access to the super app to check for any last-minute issues.

Tata Capital, which has a significant retail and corporate loan portfolio, is also expected to chip in by offering loans to its super app customers.

Mukesh Ambani-owned RIL is investing heavily in building its super app ecosystem and will offer services from movie ticket bookings to travel tickets. It is also planning to integrate the database from its latest acquisition, JustDial, to help customers connect with small businesses around them.

Analysts are forecasting a 50 per cent market share for RIL in the online grocery market by the financial year 2024-25, with a 30 per cent market share in overall e-commerce.

“This translates into $35 billion e-commerce GMV (gross merchant value) for RIL by FY25, with $19 billion in grocery and rest by non-grocery. Overall, we expect retail Ebitda (earnings before interest, tax, depreciation and amortisation) to grow 10 times from current levels by FY30,” Goldman Sachs analysts led by Nikhil Bhandari said in a note to its clients.

The new entrants would make a dent in the market share of Paytm, Amazon, and Flipkart that are offering a range of services to their customers, including payment gateways and air ticket bookings. According to RedSeer, a management consulting firm in India, Paytm is currently the leading payments platform in India with a gross merchant value (GMV) of Rs 4.03 trillion as of March 2021. “But with cash-rich conglomerates entering the market, it will be interesting to watch how the current players retain their market share,” said another banker.

Source: Read Full Article