Philly Fed Index Indicates Notably Slower Growth In April

Growth in Philadelphia-area manufacturing activity slowed more than expected in the month of April, according to a report released by the Federal Reserve Bank of Philadelphia on Thursday.

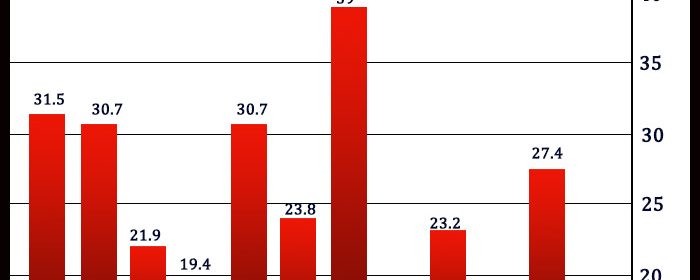

The Philly Fed said its diffusion index for current activity slumped to 17.6 in April from 27.4 in March. While a positive reading still indicates growth, economists had expected the index to show a more modest drop to 21.0.

The bigger than expected decrease by the headline index came as the new orders index slid to 17.8 in April from 25.8 in March, and the shipments index tumbled to 19.1 from 30.2.

On the other hand, the number of employees index rose to 41.4 in April from 38.9 in March, indicating modestly faster job growth.

The report showed the prices paid index also climbed to 84.6 in April from 81.0 in March, while the prices received index inched up to 55.0 from 54.4.

Looking ahead, the diffusion index for future general activity plunged to 8.2 in April from 22.7 in March, hitting the lowest level since December 2008, although the Philly Fed noted firms generally continue to expect growth over the next six months.

“Healthy consumer goods spending and business investment will also keep factories humming, but manufacturing will face a difficult supply-side situation this year,” said Oren Klachkin, Lead US Economist at Oxford Economics.

“Production costs will stay high as the war in Ukraine ripples through commodity markets and China’s strict Covid containment policy keeps strains within logistics channels high,” he added. “On the bright side, much better health conditions will reduce US labor supply problems.”

Last Friday, the New York Fed released a separate report showing a substantial rebound in New York manufacturing activity in the month of April.

The New York Fed said its general business conditions index soared to a positive 24.6 in April after tumbling to a negative 11.8 in March. A positive reading indicates an expansion in regional manufacturing activity.

Economists had expected the general business conditions index to show a much more modest rebound to a positive 0.5.

However, the New York Fed said firms were significantly less optimistic about the six-month outlook than in recent months.

The index for future business conditions tumbled to 15.2 in April from 36.6 in March, falling to its lowest level since early in the pandemic.

Source: Read Full Article