Mortgage rates too high? Not according to inflation – The Denver Post

“Memory Lane” takes a stroll through financial history because the economy has a funny habit of repeating itself.

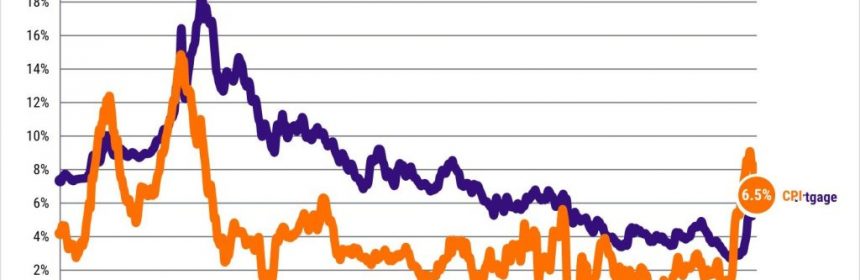

Buzz: Mortgage rates have run below the inflation rate for 21 months, breaking a record-setting streak from nearly a half-century ago.

Source: My trusty spreadsheet looked at the monthly average of 30-year fixed-rate mortgage rates from Freddie Mac and compared them with the annualized inflation rates from the Consumer Price Index.

Numbers: You might be thinking that mortgage rates are high as the Federal Reserve tries to ice a nasty bout of inflation with pricier money. But history suggests home loans are relatively cheap when compared with the rising cost of living.

In December, 30-year mortgage rates averaged 6.4% – up from 3.1% 12 months earlier. The yearly rate of inflation as measured by the CPI was 6.5% – down from 7% in December 2021.

So 2022 ended with mortgage rates at the closest they’ve been to inflation since this loan benchmark first fell below the CPI’s gain in April 2021. But the last time mortgages ran below inflation for such an extended period was the 20 months ending in July 1975.

How long ago?

Do you remember July 1975? Let’s jog your memory …

News: The Apollo space program ended. ARPANET, the predecessor to the Internet, began to work. And Jimmy Hoffa, the former Teamsters Union president, was reported missing.

Business: Stocks fell 6% in their worst month since the 1973-74 market crash, as questions arose about the strength of recovery from a 16-month recession that ended in March 1975.

Culture: “Jaws” was the No. 1 movie, the musical “A Chorus Line” opened on Broadway, and Bruce Springsteen finished work on his “Born to Run” album.

The back story

Geopolitical tensions ballooned inflation in the early 1970s.

Oil prices skyrocketed after an Arab oil embargo was imposed on the U.S. This set off several waves of inflation over a decade.

The Federal Reserve acted slowly in its response to the soaring cost of living, one of many federal policy mistakes that led to a lengthy slow-growth period of “stagflation.”

In the entire 1970s, the U.S. economy grew at a 3.2% annual rate, after inflation. That may seem robust, but it was down from a 4.3% average in the 1950s and 1960s.

The result

Inflation raced past mortgage rates in the early 1970s.

By 1973, inflation had risen to 8.7%, a huge jump from 3.4% at 1972’s end. The 8.5% mortgage rate at year-end 1973 was up from 7.4% 12 months earlier.

And one year later, inflation would rise to 12.3% while mortgages ended 1974 at 9.6%.

As a recession raged, home-loan rates stayed below the inflation rate until August 1975. That’s when CPI gains were down to 8.6% and mortgages were at 8.9%.

Caveat

Most real estate gurus don’t watch this relationship between mortgage rates and CPI inflation. These folks typically follow other inflation measures and/or the gap between mortgage rates and the yield on the 10-year Treasury bond.

Yet almost all housing analysts were surprised by 2022’s mortgage rate jump that pushed borrowing costs to 6.9% in October.

But the mortgage-CPI math flashed warning signals that rates were too low as early as April 2021 – the first time in 41 years that mortgages were below inflation.

History lesson

Mortgage rates just being close to inflation rates is an economic oddity. So when it happens again, be prepared.

Since 1971, mortgage rates have averaged 7.8% while inflation has run at 4% – a historic 3.8 percentage-point gap between home loans and the CPI’s rate of change.

Why? Folks lending out money long-term want to get a return well in excess of inflation. So the enduring lack of any mortgage-inflation gap in early 2023 is worrisome.

Yes, inflation this time around has been different. The Fed created the cheapest mortgage rates in history as part of a massive economic stimulus by government forces aimed at softening the economic pain of the pandemic era.

But that generosity combined with goods and labor shortages and helped create 40-year high inflation. So the Fed now is raising the rates it controls – much to the dismay of the rate-sensitive real estate world.

However, inflation must be tamed. History says, looking at the 1970s, that if the cost of living isn’t kept in check, the risks of an extended period of economic weakness will grow.

Quotable

Mary Daly, president of the Federal Reserve Bank of San Francisco, told me in November that just the fact that there’s debate about the formula to set mortgage rates says something about the economy.

“When inflation is low and stable, nobody has to worry about it. These correlations don’t work,” she said. “That’s actually a good thing for the economy. It means that people can make different decisions other than ‘How am I going to keep up with inflation?’ whether they’re a business or a household?”

Jonathan Lansner is business columnist for the Southern California News Group. He can be reached at [email protected]

Source: Read Full Article