LifeStance Health: Waiting For A New Lease Of Life

Shares of LifeStance Health Group Inc. (LFST) are down 76% from their all-time high of $29.81, recorded last July, and trade around $7.

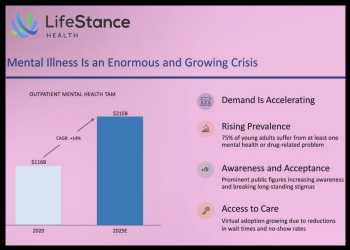

It was on this day last year, i.e., June 10, 2021, that this provider of virtual and in-person outpatient mental health care for children, adolescents and adults experiencing a variety of mental health conditions, made its debut on the Nasdaq Global Select Market, pricing its shares at $18 each.

As of March 31, 2022, the company employed 4,989 psychiatrists, advanced practice nurses, psychologists and therapists through its subsidiaries and affiliated practices. Revenue is generated on a per visit basis as clinical services are rendered by the company’s clinicians.

LifeStance considers 2021 a milestone year because it was able to successfully drive significant topline growth and rapidly expand its clinician population.

Net loss for full-year 2021 was $307.2 million on revenue of $667.5 million.

The company reported financial results for the first quarter ended March 31, 2022, last month.

Net loss available to common stockholders widened to $62.3 million or $0.18 per share in the first quarter of 2022 from $45.4 million or $0.15 per share in the year-ago quarter. Revenue for Q1, 2022 rose to $203 million from $143 million in the year-earlier period.

For the second quarter of 2022, the company expects revenue in the range of $209 million to $214 million.

Looking ahead to full-year 2022, LifeStance anticipates revenue to range between $865 million and $885 million, implying a year-over-year growth of nearly 30% to 33%.

Cash position:

LifeStance had cash of $114.0 million and net long-term debt of $177.4 million as of March 31, 2022.

LFST has thus far hit a low of $5.43 and a high of $29.81. The stock closed Thursday’s trading at $7.15, down 3.90%.

Source: Read Full Article