‘India is Asia’s best post-Covid recovery story’

Christopher Wood, global head of equity strategy at Jefferies reiterate his bullish view on Indian equities on the back of a steady fall in Covid cases coupled with a sharp economic recovery in India, reports Puneet Wadhwa.

A steady fall in Covid cases coupled with a sharp economic recovery in India has made Christopher Wood, global head of equity strategy at Jefferies reiterate his bullish view on Indian equities.

In December 2020, Wood raised exposure to Indian equities twice in his Asia ex-Japan long only portfolio.

“With Covid cases in India now 88 per cent off their peak amid growing hopes of herd immunity, India looks right now Asia’s best post-Covid recovery story,” Wood wrote in his weekly note to investors, GREED & fear.

For the stock market to have a real nasty unwind at the global level rather than just a bull market correction, Wood believes there needs to be a catalyst in the form of an economic downturn or a material tightening in US Federal Reserve’s (US Fed) policy. He ruled out the possibility of either of these catalysts materialising.

“The risks are building for obviously overvalued US equities, and in particularly high PE growth stocks. But before those risks become reality treasury bonds have to sell off more and cyclical stocks to rally more,” Wood said.

Rising inflation expectations, he believes, is another reason that will boost cyclical trades going ahead, and the best way to play this is via bank and oil-related stocks.

“One of the favoured cyclical areas is, clearly, banks. Banks in Europe and Asia ex-Japan offer over 40 per cent upside if they simply re-rate to a level of one standard deviation below the long-run mean in terms of the relative price to book multiple,” Wood wrote.

With oil prices crossing $61 per barrel mark for the first time in 13 months has yet again stoked fears of inflation, especially for India that imports around 70 per cent of its crude oil requirement. Since November 2020, oil prices are up over 60 per cent.

“Despite the risks, we believe Saudi and OPEC+ actions have put a new price floor of $50 per barrel for 2021. Expect dated Brent prices to be in low to mid $50/barrel for much of 2021, with stronger support in the second half of the year,” says Chris Midgley, global director of analytics at S&P Global Platts.

At the bourses back home, while the S&P BSE Oil & Gas index has underperformed (up 67 per cent since March low) the frontline S&P BSE Sensex that has gained 93 per cent since then, the S&P BSE Bankex has moved up 106 per cent during this period.

Buy bitcoin on a dip

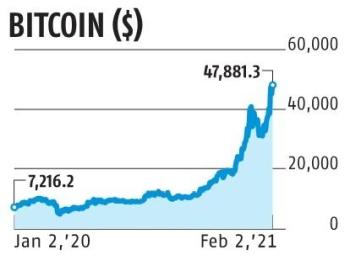

Despite a sharp surge in bitcoin over the past few weeks, Wood still remains bullish on bitcoin and suggests investors use any decline in the cryptocurrency to buy.

In December 2020, Wood had trimmed exposure in gold in favour of bitcoin in his long-only global portfolio for US dollar-denominated pension funds and bought the cryptocurrency around the $20,000 mark.

“GREED & fear remains extremely bullish on Bitcoin and advises those who are not invested to take advantage of any pullbacks. Remember that institutional ownership of Bitcoin has only just begun,” Wood said in his recent note.

Bitcoin rose by 85 times in the 12 months after the first halving in November 2012. So far, it has risen 418 per cent since the most recent halving in May 2020, data show.

The recent spurt was after Elon Musk said he invested $1.5 billion of Tesla’s $19.4 billion of cash into Bitcoin in January.

Earlier, Nasdaq-quoted MicroStrategy invested almost all of its own treasury funds in Bitcoin in the second half of 2020.

Feature Presentation: Rajesh Alva/Rediff.com

Source: Read Full Article