Goalsetter looks to drive engagement by boosting financial literacy among kids

- Goalsetter raised $3.9 million in seed funding to expand its kid-focused banking app, which uses financial literacy tools to promote wealth equality.

- And three of its core characteristics highlight major trends in the neobank space.

- Insider Intelligence publishes hundreds of research reports, charts, and forecasts on the Banking industry with the Banking Briefing. You can learn more about subscribing here.

The kids-focused banking startup will apply its newly raised $3.9 million in seed funding to expand its mobile app and accelerate subscriber growth, CNBC reports.

Goalsetter offers peer-to-peer (P2P) payments and a debit card for purchases. The startup's overarching mission is to combat US wealth inequality by improving financial literacy, especially among Black youth. For example, its "learn before you burn" feature lets parents lock their kids' debit cards until they complete weekly financial literacy quizzes, while "learn to earn" allows parents to deposit money that kids can win in return for correct quiz answers.

Goalsetter's offerings and business model are reflective of three current trends in the US neobanking space:

- Kids-focused banking apps are becoming increasingly prevalent. As fintechs and banks come to recognize the value of cementing lifelong users at an early age, there's been an influx of financial solutions geared toward this demographic: For example, Greenlight's 2 million users have collectively saved over $50 million since its 2017 launch. And teenager-focused banking app Step added 500,000 users in its first two months. Though the field is crowding, Goalsetter could get a brand name boost from its roster of celebrity investors—including NBA stars Kevin Durant and Chris Paul.

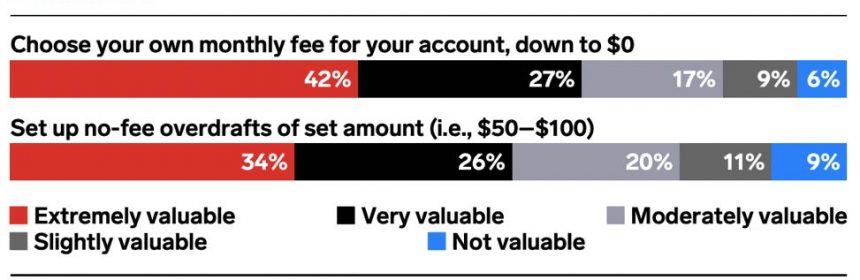

- A "pay what you think is fair" fee structure addresses a major pain point. Customers of the top five US banks collectively paid over $1 billion in checking account maintenance fees in 2018—so it's unsurprising that optional fees are highly attractive. Goalsetter employs this pricing structure, and believes that paying customers will ultimately subsidize nonpaying ones, opening up the service to those who may be unable to pay a monthly fee. Other US neobanks have also put an altruistic spin on the model: Aspiration donates 10% of users' self-selected monthly fee to charity. Though it will dent Goalsetter's profitability potential, pay-what-you-wish will be an important customer acquisition tool—and the startup will instead rely on sponsorship revenues and potential white-labeling partnerships with banks to turn a profit.

- A mission-driven approach allows neobanks to stand out and attract a more engaged, loyal customer base. As Goalsetter's focus on improving financial literacy is closely intertwined with its features and pricing model, customers could be enthusiastic about engaging with the platform and committed to supporting that mission in the long term. This approach is similar to Ando, a mobile banking app that looks to engage environmentally conscious customers by investing their funds only in green, emissions-reducing initiatives. With this strategy, banking apps can appeal not only to customers' financial needs, but also to their passions and personal missions, which encourages greater loyalty in the long term.

Want to read more stories like this one? Here's how you can gain access:

- Join other Insider Intelligence clients who receive this Briefing, along with other Banking forecasts, briefings, charts, and research reports to their inboxes each day. >> Become a Client

- Explore related topics more in depth. >> Browse Our Coverage

Current subscribers can access the entire Insider Intelligence content archive here.

Learn more about the financial services industry.

Source: Read Full Article