Frontier and Spirit merger would create the fifth-largest airline in the US

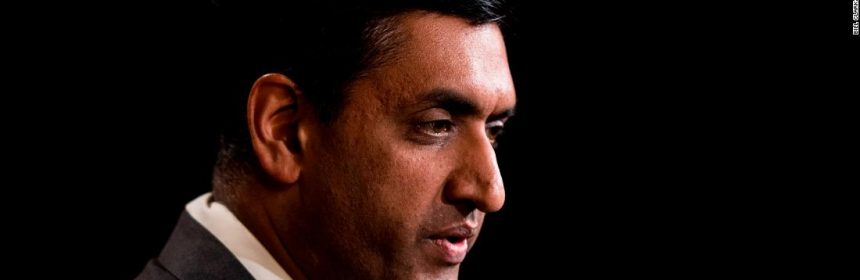

New York (CNN Business)California Democratic Congressman Ro Khanna is shrugging off potential antitrust issues in the proposed $6.6 billion merger of low-cost carriers Spirit and Frontier Airlines. But he does have one other big concern.

“Look, the DOJ should review it,” Khanna told CNN in a phone interview Monday. “But having flown Spirit just twice in my life, and both times having my bags lost, I can’t imagine the consumer experience could get worse.”

If approved by regulators, the deal would create America’s fifth-largest airline, offering more than 1,000 daily flights to over 145 destinations.

Khanna said it doesn’t seem this deal is going to “threaten huge market share.” The Big Four carriers — American (AAL), Delta (DAL), United (UAL) and Southwest Airlines (LUV) — control about 80% of US passenger air traffic.

Both Spirit and Frontier often get poor marks from customers. The two airlines were ranked at the bottom of all major carriers in the American Customer Satisfaction Index for each of the past seven years.

“Obviously it has to be reviewed. But if they can make an argument this is going to improve the consumer experience, it ought to be considered,” Khanna said. “Not every merger by definition is anticompetitive.”

Just hours after announcing the planned merger, Frontier requested a nationwide ground stop from the FAA due to what the airline described as a “technology issue.” The ground stop has since been lifted, according to the FAA.

Progressives in Washington, led by Senator Elizabeth Warren, have advocated for an antitrust crackdown. The Biden administration has moved to block a series of major deals, including Nvidia’s (NVDA) $40 billion takeover of chip design firm Arm and a $30 billion deal between insurance brokerages Aon (AON) and Willis Towers Watson (WLTW).

-CNN’s Chris Isidore and Pete Muntean contributed to this report

Source: Read Full Article