What is SegWit2x and how could it affect Bitcoin?

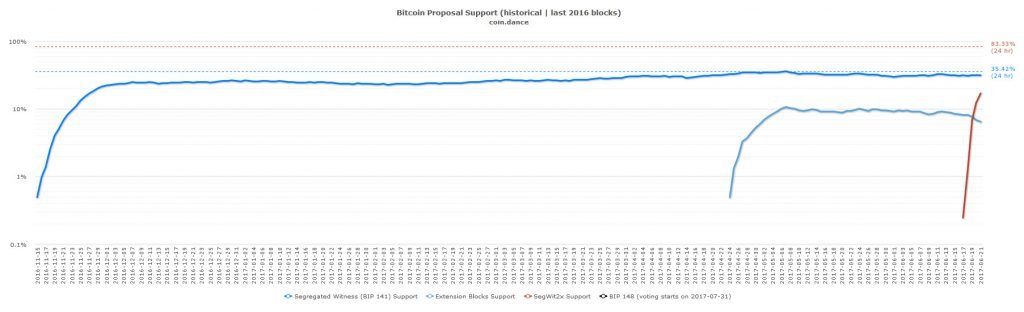

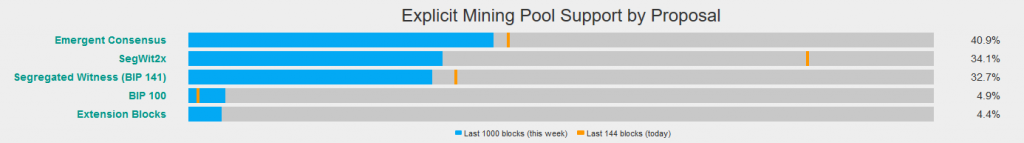

A majority of miners have started showing their preference for SegWit2x, a version of Segregated Witness that’s deviating from what Core developers envision to be the solution to bitcoin’s scaling issue. But what is it and what’s leading bitcoin to it?

Recent events have led to increased demand for a solution to bitcoin’s scaling issue. With bitcoin blocks getting filled with transactions as bitcoin’s use is trending near all-time high levels,transaction fees are on the rise. The combination of this, along with the rising price, makes bitcoin transactions more expensive than ever at a time that bitcoin’s use as currency is becoming less convenient.

While several proposals have already been made to address the scaling of bitcoin, the miners were seemingly leaning towards Bitcoin Unlimited. That was until BIP148 developers announced the plan for a soft fork on August 1st, with the intent to bring forth SegWit.

However, Chinese miners didn’t stand by this decision as most had previously stated they weren’t satisfied with 1MB blocks. In a recent blog post, Bitmain (the largest mining equipment manufacturer) detailed how their vision for a decentralized and widely accepted bitcoin doesn’t see it continuing to have 1MB blocks and high fees.

The tone of this blog post earned Bitmain harsh criticism from some members of the bitcoin community, but what really matters is that the incorporation of Segregated Witness is something coming closer and closer to reality.

Parties collectively accounting for more than 80% of the hashrate for bitcoin mining attended and agreed upon the above points. What’s notable though, is that this agreement goes directly against the proposal of Core developers. It’s slowly becoming apparent that the majority of miners in terms of hash power aren’t satisfied with the vision Core developers have for bitcoin and both sides are prepared for a chain split.

Announced in the aforementioned blog post was the release of a new software project catering to the Segwit2MB proposal agreed upon in what’s dubbed at the New York Agreement.

The SegWit2MB proposal states:

In short, SegWit2x seems to be building on the already popular proposal of SegWit, but with the difference that a hard fork will be needed to implement bigger blocks. This proposal intends to bring on SegWit as soon as miner support surpasses a certain limit, and only lock in a hard fork at a fixed date to implement a bigger block size cap if the overwhelming support of miners is received.

The proposal states that the SegWit2x hard fork is only set to lock in if the event that the a majority of miners approve it, but we might see a soft fork activation of SegWit sooner than expected. Thankfully, most bitcoin nodes are upgraded to versions post 0.12 and are hence ready for SegWit.

While more than 80% of the hash-rate is a good indicator of what proposal miners are leaning towards, it’s ultimately the demand from the economy that makes the final decision. Provided that a split is likely to happen on August 1st, no miner would continue mining a coin with no value. So if traders and the overall economy is observed to be picking a side, miners would likely follow suit.

A word on bitcoin wallets

Many bitcoin community members have been urging users to move their coins to wallets that allow them to access their private keys. Because in the event of a chain split, it’s the owner of the private key that decides upon what happens to coins stored in the bitcoin addresses. Exchanges and services that hold user funds could theoretically only provide users with access to coins on the chain they support in the event of a split, which makes the users subject to their decisions.

Source: Read Full Article