Purpose Bitcoin ETF Puked 24.5k BTC on Friday, Leading to the Weekend Low of $17.6k – Arthur Hayes

Summary:

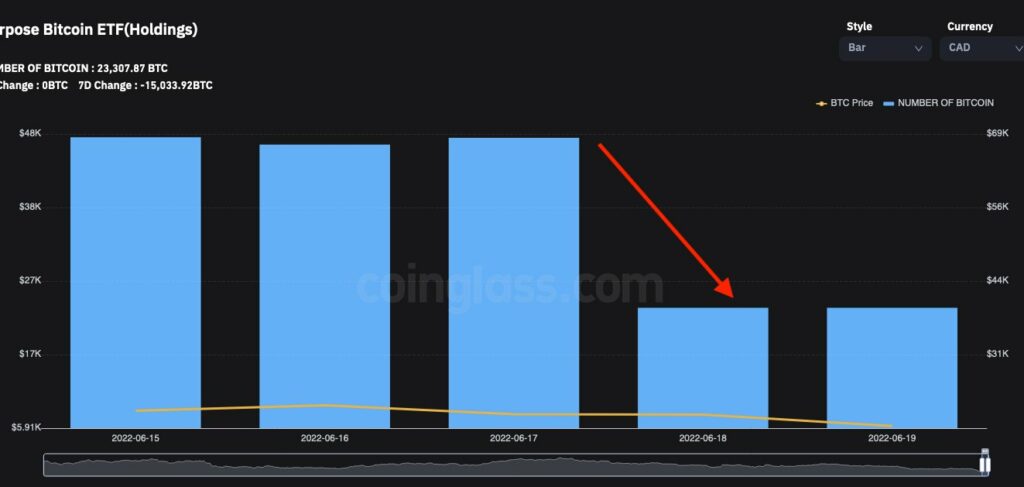

- Arthur Hayes has highlighted that the Purpose Bitcoin ETF offloaded 24.5k BTC into the markets on Friday’s close.

- Bitcoin went on to drop to the local low of $17,600 due to the selling pressure that could have been a run to trigger stop losses.

- The Bitcoin and crypto markets have since rallied, with BTC trading above $20k.

The co-founder and former CEO of Bitmex, Arthur Hayes, has shared an interesting observation regarding what might have caused Bitcoin’s dump below $20k to a local low around the $17,600 price level.

Purpose Bitcoin ETF Puked 24k BTC on Friday.

According to Mr. Hayes, the Purpose Bitcoin ETF offloaded 24,500 BTC into the American close on Friday, leading to a lot of selling pressure that could have been a run to trigger stop losses. He shared his analysis of the volatile weekend through the following statement and accompanying charts.

BTCC – Purpose ETF puked 24,500 $BTC into the North American Friday close. I’m not sure how they execute redemptions but that’s a lot of physical BTC to sell in a small time frame.

Over the weekend, while the fiat rails are closed, $BTC dropped to a low of $17,600 down almost 20% from Friday on good volume. Smells like a forced seller triggered a run on stops.

Not a Guarantee that the Bitcoin and Crypto Turmoil is Over.

Mr. Hayes shared that after the Bitcoin was dumped, the crypto markets soon rallied in low volumes. Bitcoin has regained the crucial $20k support level, and Ethereum has reclaimed $1k.

He also added that given the obviously ‘poor state of risk management by crypto lenders and over-generous lending terms,’ crypto traders should ‘expect more pockets of forced selling of BTC and ETH as the market figures out who is swimming naked.’

Arthur Hayes concluded that the selling in the Bitcoin and crypto markets might not be over. However, traders skilled at ‘knife catching’ could benefit from ‘additional opportunities to buy coin from those who must whack every bid no matter the price.’

Source: Read Full Article