Coinbase Insights: Bitcoin Rally, Spot ETFs, Institutional Interest, HODLer Trends

On 8 December 2023, David Duong, Head of Institutional Research at Coinbase, along with David Han, Institutional Research Analyst, released their latest weekly commentary on the cryptocurrency market. Duong summarized this commentary on LinkedIn, providing insights into the current trends and future outlook of the crypto market.

Analysis of the Bitcoin Rally

David Duong notes that the recent Bitcoin rally triggered about US$256 million in short Bitcoin liquidations since December’s start. He attributes this 2.5 standard deviation move in Bitcoin, based on a 40-day window, to moderating US rate expectations, highlighted by a nearly 30 basis points drop in the 10-year Treasury yield to 4.1%. However, Duong points out that this surge in Bitcoin was not reflected in the S&P 500 or the Nasdaq, suggesting unique factors at play specifically for crypto.

Equity Market Comparison

Duong observes that equities like the S&P 500 and Nasdaq have been moving sideways, possibly due to predictions of a pullback by several sell-side banks following the gains in November. This contrasts with the Bitcoin rally, indicating differing market dynamics.

Spot Bitcoin ETF Developments

Focusing on spot bitcoin ETFs, Duong discusses the updated S-1 filings by BlackRock and Bitwise. He notes the detailed changes addressing concerns from custody arrangements to the creation of an Intraday Indicative Value (IIV), indicating readiness for launch and a high level of SEC scrutiny.

The Intraday Indicative Value (IIV) is a real-time estimate of an Exchange-Traded Fund’s (ETF) net asset value, calculated and updated regularly throughout the trading day. It’s derived by assessing the current prices of the ETF’s holdings, subtracting liabilities, and dividing by the number of outstanding shares. This measure is particularly vital for ETFs tracking volatile markets, like cryptocurrencies, as it provides investors with a continuously updated value of the fund. The IIV helps in determining if the ETF is trading at a premium or discount to its real value, offering transparency and aiding investors in making informed trading decisions.

Institutional Crypto Appetite

Duong highlights the growing institutional interest in cryptocurrencies, evidenced by the rise in the CME futures basis for bitcoin and ether. He suggests that institutions lacking direct BTC or ETH spot access have been paying a premium for crypto exposure, though this has normalized with the front month on both assets.

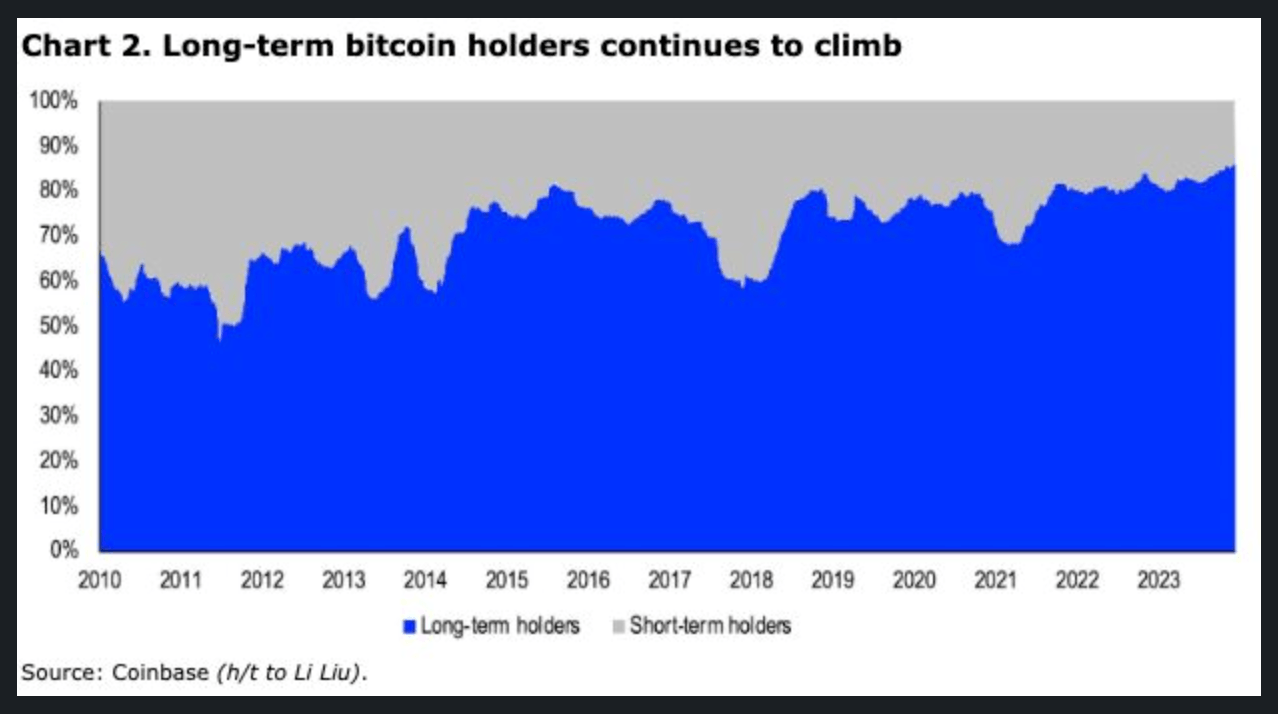

Long-Term Bitcoin Holder Behavior

Duong points out that the percentage of long-term Bitcoin holders increased to 86% in early December. This trend, according to Duong, suggests that the recent price appreciation has not yet prompted these long-term holders to take profit, contrasting with previous market cycles.

Featured Image via Coinbase

Source: Read Full Article