Central Banks’ Monetary Policy is Dominating Bitcoin and Crypto – Weiss Ratings

Key takeaways:

- Weiss Ratings believes that Bitcoin and the crypto markets are being dominated by the ongoing monetary policies of various global central banks.

- They forecast an inflationary future where current politicians lose their jobs for plunging the world into a deflationary depression.

- Bitcoin and crypto will finally move upward when new legislators pressure central banks into reversing their tightening policies.

Bitcoin and the crypto markets are currently attempting to brush off news of the record-breaking 8.6% inflation in the United States. The latter is the highest in the United States in 40 years.

Bitcoin and Crypto’s Fate is Tied to the Monetary Policy of Central Banks

The team at Weiss Ratings has since provided valuable insights into what is leading the ongoing pullback in the traditional and crypto markets. According to their analysis, there is weakness in stocks and bond markets.

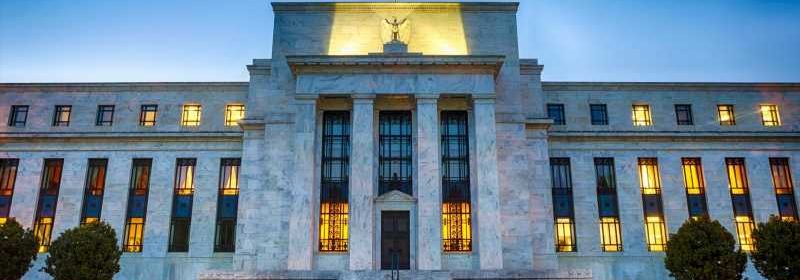

However, Bitcoin has managed to stay relatively stable but its fate is tied to the ongoing monetary policy by the global central banks such as the US Federal Reserve and the ECB. They explained:

It’s hard to give any weight to crypto-related news and projects when the real factors affecting the market are higher rates and central banks committed to tanking the world economy, doing whatever it takes as long as it means saving the dollar.

It’s hard to give any weight to crypto-related news and projects when the real factors affecting the market are higher rates and central banks committed to tanking the world economy, doing whatever it takes as long as it means saving the dollar.

The Future is Inflationary, Current Politicians Will Lose their Jobs.

With respect to a possible future, the team at Weiss Ratings anticipates that it will be an inflationary one. They explain that the current crop of global politicians will lose their jobs after plunging the world into a deflationary depression.

Consequently, their successors will ‘appease the crowd by pressuring central banks in the opposite direction.’ This will lead to possible welfare checks or other inflationary measures, thus continuing the cycle.

Therefore, until the above happens, Bitcoin and the crypto markets will not move in the desired upward direction.

Source: Read Full Article