Celsius Network’s Assets Could Be Locked for a Long Long Time Like Mt. Gox’s Crypto, Says Bitfinex Whale.

Summary:

- Bitfinex Bitcoin whale, Joe007, has warned that Celsius Network’s assets could be locked for a ‘long long time’ just like Mt. Gox’s crypto has been locked since 2014.

- Celsius Network has filed for Chapter 11 bankruptcy.

Bitfinex Bitcoin whale known as @Joe007 has warned that Celsius Network’s assets could be locked for a long time due to the company filing for bankruptcy.

@Joe007 gave the example of Mt. Gox’s bankruptcy filing of 2014 that has only recently started to show signs of resolving with creditors requested by the exchange’s trustees to declare how they want their locked crypto distributed.

@Joe007 shared his insights into Celsius Network filing for bankruptcy and its assets being frozen for a long time through the following tweet.

In practical terms, it means that up to $9B in Celsius crypto assets are now locked, possibly for a long long time. Remember how long it took to sort out 2014 MtGox bankruptcy? https://t.co/T1iLax8B8K

— Joe007 alerts·groups·funds? Scam! (@J0E007) July 14, 2022

Celsius Network Files for Bankruptcy, Showing Pharos USD Fund as its Biggest Creditor, which Has Links to Alameda Research.

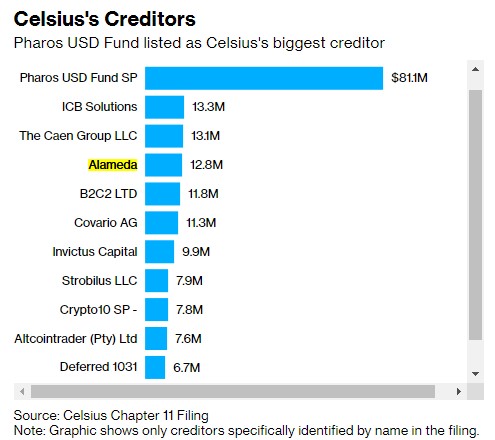

As earlier mentioned, Celsius Network filed for bankruptcy, and a Bloomberg report has unveiled that Celsius owes a company known as Pharos USD Fund a total of $81.1 million.

According to the team at Bloomberg, searching for Pharos USD Fund on Google does not ‘yield any results.’

Furthermore, Pharos USD Fund is an affiliate of Lantern ventures; a London-based ‘proprietary trading firm focused on cryptocurrencies.’ Lantern has about $400 million under management, with over 50% belonging to investors outside the United States.

What is interesting is that Lantern’s Chief Executive Officer, Tara mac, is a co-founder of Sam Bankman-Fried’s investment firm known as Alameda Research. Information gathered from LinkedIn states that another Lantern employee, Victor Xu, was a trader for Alameda for nine months in 2018.

Alameda Research is in itself owed $12.8 million by Celsius Network.

However, Celsius Network Will Remain Operational.

To note is that Celsius Network has stated that it has ample liquidity to the tune of $167 million in cash to support certain operations during restructuring in line with its bankruptcy process. It explained:

Celsius has $167 million in cash on hand, which will provide ample liquidity to support certain operations during the restructuring process.

To ensure a smooth transition into Chapter 11, Celsius has filed with the Court a series of customary motions to allow the Company to continue to operate in the normal course. These “first day” motions include requests to pay employees and continue their benefits without disruption, for which the Company expects to receive Court approval. Celsius is not requesting authority to allow customer withdrawals at this time. Customer claims will be addressed through the Chapter 11 process.

Source: Read Full Article