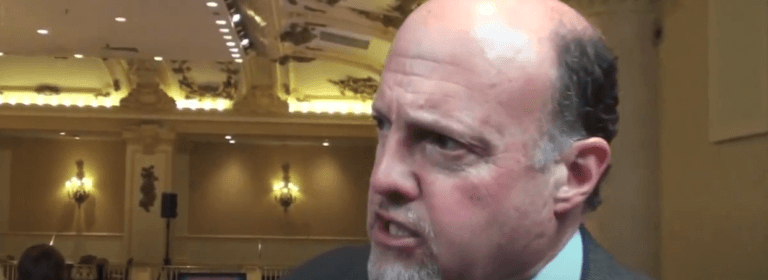

$BTC: Jim Cramer Says “Ignore the Crypto Cheerleaders Now That Bitcoin’s Bouncing”

Former hedge fund manager Jim Cramer says he is not impressed with Bitcoin’s recent price surge.

Cramer is the host of CNBC show “Mad Money w/ Jim Cramer“. He is also a co-anchor of CNBC’s “Squawk on the Street“, as well as a co-founder of the financial news website TheStreet.

On 23 December 2022, during an appearance on CNBC’s “Squawk on the Street”, Cramer told the program’s anchor Carl Quintanilla:

“One of the reasons was why I’m upset, and I think the SEC should be a little more over these things is when we look at a filing of a stock, you know who owns it. We don’t know what this guy is…

“I mean, I sold all my crypto. I announced everything on TV what I did with crypto, but I would not touch crypto in a million years because I didn’t trust the deposit bank… They fought regulation. They didn’t want regulation. And you don’t have regulation. So, if you have your money in any of those, look, I’m not calling you an idiot. I’m just saying you’re using a lot of blind faith…

“Try to get your money out… I’m not going to mention the firm that I had my money in, but it was a fight to get the money out. A fight. And i think that everybody who owns these various coins, you know, Solana, Litecoin, I do think you’re an idiot… I did not go to college to get stupid. These people who only these things should not own them…

“I think they need to do a big sweep. They have to stop having people creating money, Carl…. These are worse than even the worst Nasdaq stocks.“

Then, on 9 January 2023, he told his 1.9 million Twitter followers that this was a good chance to get out of crypto, which prompted Dan Held, Bitcoin educator and marketing advisor at Trust Machines, to say that Cramer’s comment meant that the crypto market had bottomed:

According to data by TradingView, since Cramer’s tweet on 9 January 2023, the price of Bitcoin has gone from $17,276 to 422,865, which is a gain of around 32.35% vs USD:

However, these gains over the past two weeks have not been enough to convince Cramer that Bitcoin’s current rally has legs because yesterday (23 January 2023), according to a report by CNBC, he had this to say:

“Now that Bitcoin’s spent the last couple of weeks bouncing off its lows, the whole crypto industrial complex is back in full gear trying to entice people back in. I think that would be a huge mistake for you, which is why tonight we’re going off the charts with the help of Carley Garner…

“Now everybody knows that Bitcoin has had a legion of cheerleaders even after the FTX debacle and the wave of crypto changes either going under or getting charged by the SEC or both. They haven’t stopped.

“For years, these people told us that Bitcoin was the perfect replacement for gold as an alternative asset. They said it was a great hedge against inflation in a world where central banks were printing money like crazy, but in reality, it wasn’t a hedge against anything…

“I want you to take a look at this chart. This is a daily chart of the Bitcoin futures and the Nasdaq 100 futures going back to 2021… You know what it means. It means it’s a risk asset. Not a currency, not a stable store hold of value. Imagine business owners, trying to conduct transactions with shares of Facebook or Google…

“The question is, why is crypto practically trading in lockstep with the Nasdaq 100?… might have something to do with… counterparty risk, the probability that the other party in an investment or transaction might not hold up their end of the deal. For example, if the crypto brokerage fails — like so many have — the clients might not get their money back. That’s counterparty risk…

“As Garner sees it, whenever the economy is in trouble, investors flee from anything with counterparty risk. Few professional money managers want a piece of this stuff… Of course, you can just own Bitcoin directly in a decentralized wallet; that protects you from counterparty risk, but if you ever want to use it for anything, the risk is back on the table, and as FTX’s customers learned, It can be devastating... On the other hand, gold, well, it’s the opposite...

“The charts, as interpreted by Carley Garner, suggest you need to ignore the crypto cheerleaders now that Bitcoin’s bouncing. And if you seriously want a real hedge against inflation or economic chaos, she says you should stick with gold. And I agree.“

Source: Read Full Article