Bitcoin Goes Over $40K After Paul Tudor Jones II Says He Wants 5% of His Portfolio in BTC

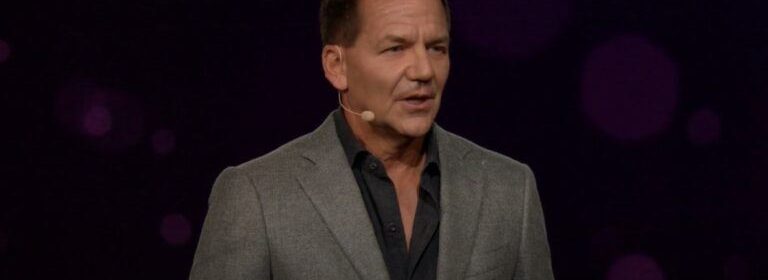

On Monday (June 14), the Bitcoin price broke above the $40,000 level for the first time since May 27 after legendary billionaire macro investor Paul Tudor Jones II (aka “PTJ”) said in an interview that he likes Bitcoin as a portfolio diversifier.

PTJ, who is the Founder and the Chief Investment Officer (CIO) of asset management firm Tudor Investment Corporation (aka “Tudor”), made his comments about Bitcoin during an interview with Andrew Ross Sorkin on CNBC’s “Squawk Box”.

PTK said:

“I like bitcoin as a portfolio diversifier. Everybody asks me what should I do with my bitcoin? The only thing I know for certain, I want 5% in gold, 5% in bitcoin, 5% in cash, 5% in commodities. At this point in time I don’t know what I want to do with the other 80% until I see what the Fed is going to do…

“For me, it’s just a way of kind of foundationally looking at how do I protect my wealth. Over time it’s a great diversifier. Again, I look at bitcoin as a story of wealth… I look at crypto as a story of wealth. Others will argue this is a different ecosystem. It’s transactional in nature.“

When Sorkin asked PTJ how he feels about the risks of holding Bitcoin (e.g. the U.S. government deciding to ban Bitcoin), PTJ replied:

“It costs more to mine gold energy-wise than it does Bitcoin. Clearly, I’m concerned about the environmental impacts of Bitcoin. If I was king of the world, I’d ban Bitcoin mining…just because the environmental impact and then make the ecosystem figure out a way to do it without expanding the supply anymore at all…“

According to data by CryptoCompare, currently (at 13:50 UTC on June 14), Bitcoin is trading around $40,655, up 13.24% in the past 24-hour period.

DISCLAIMER

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.

Source: Read Full Article