Bitcoin Battles to Hold $30k as 120k BTC Options Expire this Friday

Quick take:

- Bitcoin has just dipped to the $29,200 price area forming what looks like a doubled bottom

- Bitcoin has since regained $30k and is battling to maintain the $30,700 support area

- 120k Bitcoin options expire this Friday and could provide additional selling pressure

- However, on-chain metrics for active Bitcoin addresses hint of bullishness

The King of Crypto has just experienced a drastic dip to $29,200 – Binance rate. By dropping to this level, Bitcoin has printed what looks like a doubled bottom as seen in the following 6-hour BTC/USDT chart.

From the chart above, it can be observed that the previous low of $28,800 was set on the 22nd of this month as a result of the panic selling associated with Dr. Yellen’s statement regarding digital assets being used for illicit activities, and the overreaction to news of a Bitcoin double spend event.

120k Bitcoin Options Expire this Friday

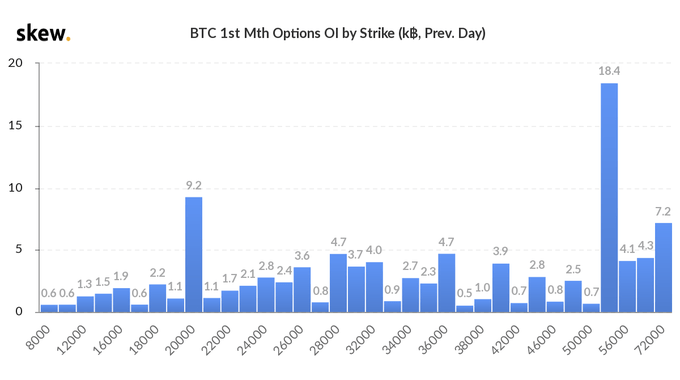

With a potential doubled bottom, Bitcoin is currently trading at $30,660 as it attempts to regain the $30,700 support zone towards the daily close. However, Bitcoin might not be out of the woods yet as 120,000 Bitcoin options expire this Friday, January 29th, and could provide additional selling pressure. This fact was highlighted by the team at Skew via the following statement and accompanying chart.

120k bitcoin options expiring this friday. The two largest pins 52k and 20k are not in play (risky statement in the GameStop world we live in!)

Bitcoin’s On-Chain Metrics Remain Strong, Price Will Increase

Bitcoin’s On-Chain Metrics Remain Strong, Price Will Increase

As Bitcoin battles to maintain the $30k – $32k support zone amidst a high number of options expiring, its on-chain fundamentals are as strong as ever. This is according to data shared by the team at Santiment which pointed out that active Bitcoin addresses are increasing by the day thus indicating that the BTC network is growing. They went on to explain that the price of Bitcoin will grow as a result.

The long-term trend of Bitcoin‘s address activity continues climbing. Both our 50-day and 200-day moving avg for addresses interacting on BTC‘s network continues to show a steady climb, which is one of our top leading indications that price will grow.

Source: Read Full Article

Bitcoin’s On-Chain Metrics Remain Strong, Price Will Increase

Bitcoin’s On-Chain Metrics Remain Strong, Price Will Increase