Bitcoin At $29,000, But Pundit Says It Could Drop Lower After Losing "One Crucial Level"

Bitcoin has been on a rollercoaster ride this week. After tapping a ten-month high of $30,800 last week, the world’s leading cryptocurrency by market capitalization embarked on a downward trajectory shedding around 9% in the past seven days. At press time, Bitcoin traded at $29,225 after a 2% drop in the past 24 hours.

Similarly, Ether faced a drawdown, giving back just over 10% in the past seven days to trade at $1,913 at press time. Other cryptocurrencies also retreated, with XRP leading in the top 10 coins by market cap with an 11% slump.

Notably, Dogecoin also dropped sharply. At press time, the world’s most popular meme had shed over 8% in the past 24 hours despite posting sizeable gains Thursday as billionaire Elon Musk’s SpaceX launched a test rocket only for it to explode shortly after.

Bitcoin Could Drop Lower, Pundit Warns

Meanwhile, as the market ends the week with its head down, various experts have cautioned that Bitcoin, Ether and other cryptos could slide lower.

According to Michael Michaël van de Poppe, founder of crypto trading firm Eight Global, Bitcoin “is currently showing weakness” and could drop to $26,200, where he sees the next support level. In a Friday tweet, the pundit warned that Bitcoin has lost “one crucial level” in its recent decline.

“Bitcoin is currently showing weakness. Broke back in the range, lost one of the crucial levels. The final crucial level is at $27,600. Could take liquidity beneath, but needs a fast recovery. If not, and no break of $28,800, then I suspect we’ll see $26,200,” said Michael.

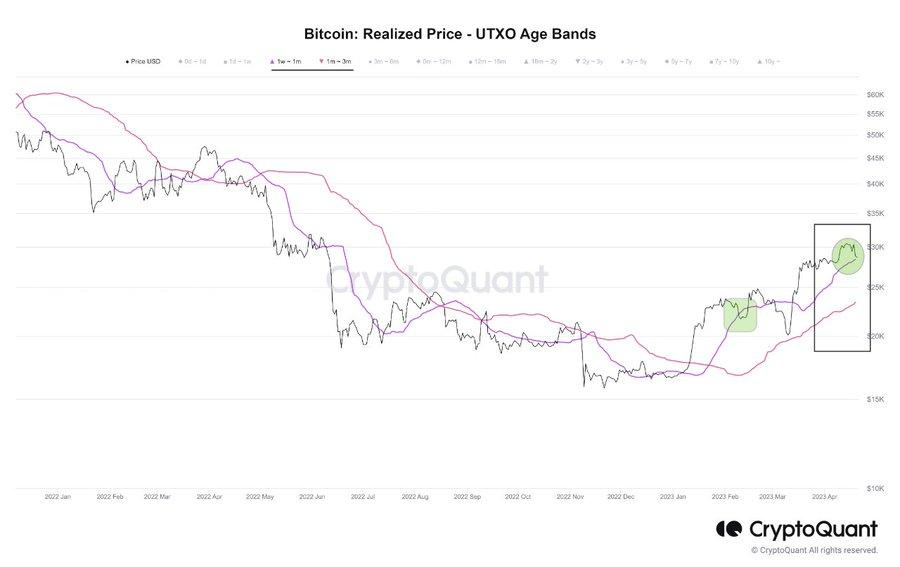

According to crypto analyst “Crazzyblockk” from Cryptoquant, Bitcoin risks dropping even lower. In a post today, the pundit highlighted Bitcoin’s UTXO Realized Price Age Distribution chart showing Bitcoin’s 1-week to 1-month age bands.

UTXO is a set of realized prices along with age bands. The metrics help us to overview each cohort’s holding behaviour by overlaying a set of different realized prices.

He noted that the $28.3k price level was a valuable zone for the bands, describing it as “a psychological level for a realized price.” According to him, the $28k level will determine the reaction of the traders in this price age and the need to take short-term profit from the asset’s recent rally.

“If Bitcoin receives a reaction from the short-term at these levels, it will be a sign of renewed interest in holding and entry by these people, and if this level breaking, these players will continue to sell,” he said adding, “If this level breaking, the oncoming valuable level is in the range of 25-23k.”

That said, despite the recent drop in price, many still believe in the long-term potential of Bitcoin, especially with the biting inflation and growing discontentment with global monetary systems.

Source: Read Full Article