Many People Do Not Know the Meaning of Segregated Witness

It appears that Litecoin will also adopt Segregated Witness or SegWit. This is a proposal on how the network of Bitcoin can be scaled so it will have the capacity to deal with higher transaction volumes. Fortunately, this proposition is gradually becoming more acceptable in a development sector that used to be divided. The core development team of Bitcoin prefers to describe this as a soft fork although ordinary individuals do not really understand what it is all about.

Litecoin is anchored on the Bitcoin code. The crypto currency’s founder (Charles Lee) believes it has no other option but to take on Segwit. The Litecoin community can adopt new technologies which include safe signature algorithms, private transactions and off-chain Lightning Network scaling protocol. This can speed up the Blockchain. A common negative perception regarding the Segregated Witness is Litecoin does not have any scaling issue. These people do not understand SegWit fixes the problem of transaction flexibility. Another cause of mix-up is the miners’ role which is to sort out transactions and secure the virtual currency.

Correcting the Misperception

Mr. Lee tried to rectify this wrong notion. He explained miners are not being asked to make their choice. On the contrary, they must indicate or signal when they can support new features. This is a way of coordinating between miners whether to accept this feature or reject it. Miners, who secure the Litecoin, can start signaling their support for SegWit. Upgrades change the manner data is kept within the crypto currency transaction. Thus, more transactions occupy lesser space on the network and include other optimizations.

The extended route towards scaling of Bitcoin does not prevent other virtual currencies from choosing SegWit. Charles Lee explains this general confusion which is Segregated Witness signal corresponds to a vote by itself. Instead, this signal means Litecoin miners are prepared to support additions to the protocol. Users or economic growth nodes should make a decision if Litecoin needs to improve its protocol.

The SegWit Benefits

According to a director of Bitcoin.com, Segregated Witness is an ideal feature that can resolve issues like transaction flexibility. This can be implemented using soft fork or change in the Bitcoin in which only valid transactions become invalid. SegWit provides two instant benefits:

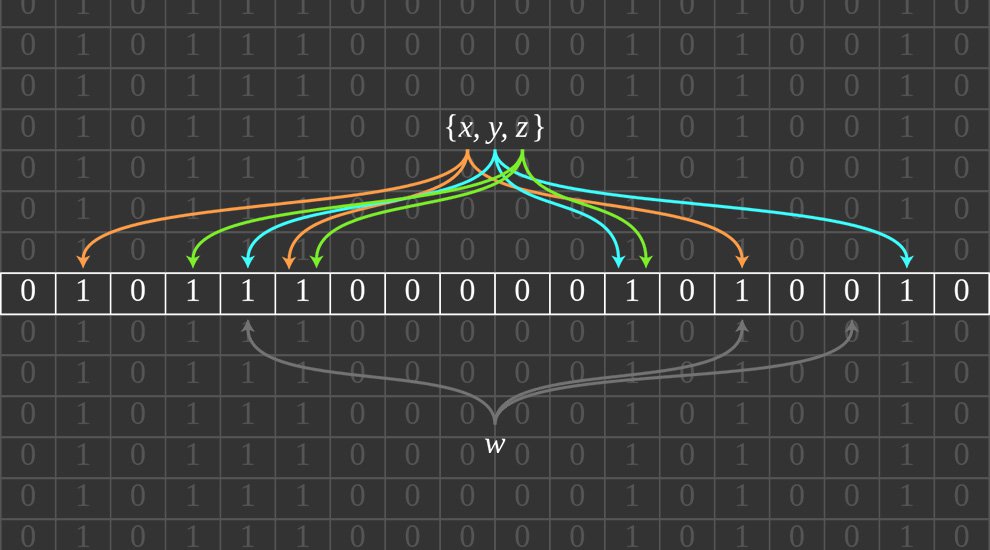

- It eliminates malleability. When you segregate the witness, the current and upgraded software receives transactions for calculating the transaction identifier of transactions using SegWit without the need to reference the witness. This addresses issues of unwelcome third-party transaction pliability. Malleability has always been a problem which makes it hard to program the wallet software of Bitcoin. It also obscures smart contracts design for the crypto currency.

- It increases capacity. When you move witness data out of the conventional block configuration, the new blocks are able to hold more data compared to their old style counterparts. It facilitates reasonable increase in transaction data volume that fits within a block.

At the same time, SegWit shortens the capacity to put in more features in Bitcoin and boosts effectiveness of full nodes. This leads to long-term advantages that benefits users.

Litecoin Takes a Risk

The Litecoin community continues to support SegWit as Bitcoin advocates try to figure out measures to deal with the block size argument. There are significant differences between Litecoin and Bitcoin. It was Mr. Lee who predicted the block size dilemma wherein Bitcoin must replace its code for scaling and therefore allow the number of transactions to increase. This was one of his considerations while creating Litecoin where a total of 84 million coins had to be mined.

According to litecoin.org, Litecoins Blockchain has more capability to handle higher transaction volume than Bitcoin. The network maintains more transactions without modifying the software because of regular block generation. Thus, merchants can look forward to quicker confirmation time and expect more confirmations while selling big-ticket items.

Digital Silver

Bitcoin is often alluded to as “digital gold” which serves as long-lasting speculative virtual instrument. On the other hand, Litecoin is sometimes described as “silver to bitcoins gold” and could become the daily transactional virtual currency for many users. Lack of knowledge about this crypto currency can be caused partly by inadequate marketing since Litecoin was introduced in the market.

During the first few months of 2014, Litecoin had over $1 billion market capitalization. However, its pricing has been unexceptional since then and outlook declined considerably sooner than the soft fork. The most recent significant price increase was recorded in September of 2015. Litecoin users however must not worry. The currency has not yet faded into anonymity. CoinMarketCap ranks Litecoin as one of the top five virtual currencies. It still has an overall market value of $172.5 million. The currency gains imaginary integrity and worth for as long as it is online and constant.

Crypto Community Observes

The virtual currency community is observing all developments that concern Litecoin and Segregated Witness. Earlier last year, Ethereum opted for a hard fork after an unidentified user ran away with stolen funds worth around $56 million that time. A number of Ethereum participants refused to follow the adaptation of hard fork and operated the unforked Ethereum Classic instead. This Blockchain minus the fork resolved the theft.

This is a risk for Litecoin if it does not adopt to Segregated Witness. There might be a Litecoin Hard Fork to allow scalability if SegWit does not get the needed support. It can depend on the decision of the Bitcoin community to use SegWit, or maybe even influence that decision. One issue is the possibility of a split in Litecoin between hard fork and soft fork supporters, not unlike we see it with Bitcoin currently. There are different possibilities so it is important for users to comprehend fully the meaning of Segregated Witness (SegWit) and its likely effects on crypto currencies, aswell as the other scalability solutions. This is a thing stakeholders should study carefully as the Blockchain technology continues to gain momentum in the industry.

Source: Read Full Article