ETH Price Analysis: Ethereum Poised for a Massive Breakdown if Support at $1,300 Fails to Hold

ETH Price recently revisited the price levels above $1,400. The bullish leg tested the resistance at $1,450 but hit an immense seller congestion. Ether’s breakout took place after Bitcoin shot up to $38,000 on Friday, mainly pumped by Elon Musk. The billionaire and founder of Tesla changed his bio on Twitter to Bitcoin, suggesting that he had purchased BTC.

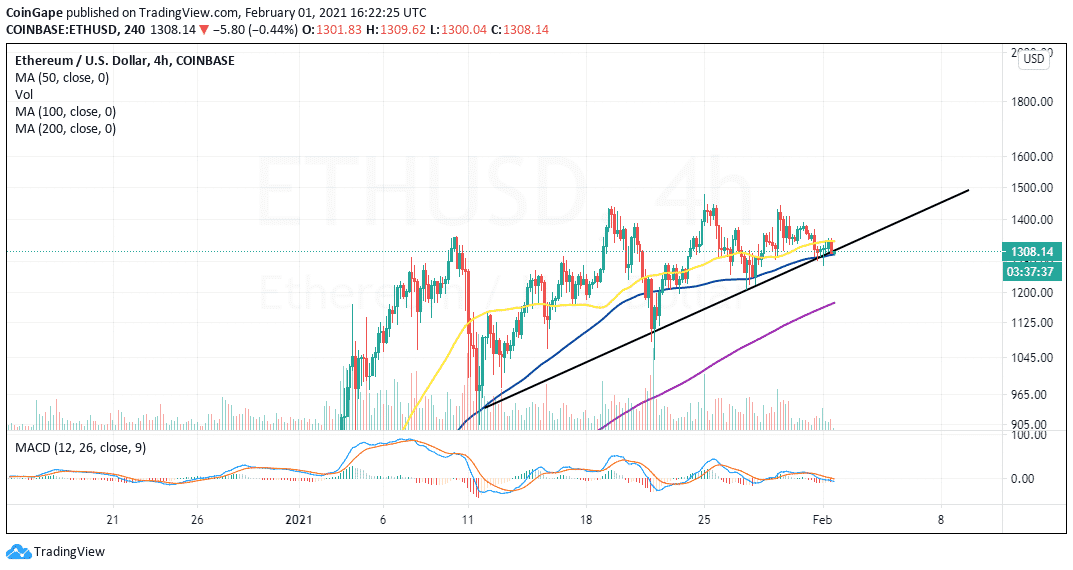

- ETH price is holding within a small range between $1,300 and $1,400.

- Ethereum will plummet to $1,200 or the 200 SMA if the support at $1,300 is broken.

Meanwhile, Eth price has retreated toward $1,300 after failing to hold above $1,400. Slightly on the upside, the 50 Simple Moving Average is cap price movement. It appears that the selling pressure is intensifying, thus jeopardizing the immediate support at the 100 SMA or $1,300.

The above support areas must be defended at all costs. Moreover, an ascending trendline helps keep the bears in line, preventing the potential breakdown to $1,200.

The Moving Average Convergence Divergence adds weight to the pessimistic outlook. This indicator follows the asset’s trend and calculates its momentum. The MACD can be used as a signal to sell or buy. It is available to sell when the MACD line crosses above the signal line and sell when the MACD line cross beneath the signal line.

ETH Price Analysis: ETH/USD 4-hour chart

For now, the least resistance path is downward based on the MACD. Note that a daily close under $1,300 may trigger massive sell orders. If enough selling pressure is created, Eth price may fall to test the support at $1,200.

The other side of the picture shows that Ethereum may avoid the breakdown entirely if the 100 SMA support remains intact. Closing the day above the 50 SAM will call for more buy orders as Eth price heads for $1,400 and $1,500.

Ethereum intraday levels

- Spot rate: $1,306

- Relative change: -7

- Percentage change: -0.5%

- Volatility: Low

- Trend: Bearish

To keep track of DeFi updates in real time, check out our DeFi news feed Here.

Source: Read Full Article