Curated blockchain and cryptocurrency news – Week 4’19

Cboe exchange withdraws VanEck-SolidX ETF proposal prematurely, IMF consulting Malta on how to continue and what to fix, South Korean exchanges joining hands to prevent scammer and hacker success, Maduro’s gold stuck in the UK due to US sanctions (Kraken CEO has something to say about that), Kik messenger likely to bravely go to court against the SEC’s accusations of them being a security, India embracing blockchain (but not in the way that we would like them to), and Iran finally announces an initial framework for allowing cryptocurrencies in the country (as well as launching and managing ICOs).

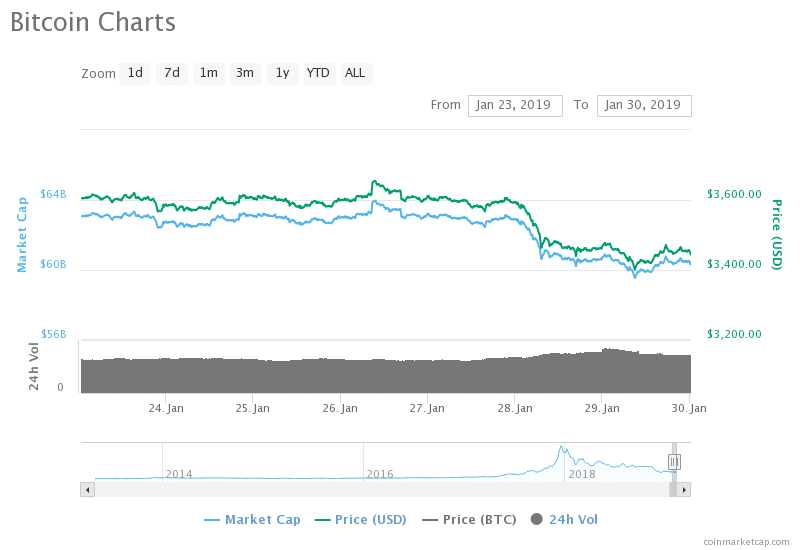

Weekly Bitcoin price

Bitcoin’s price in this last week has held on for dear life, but finally support gave way near the end as we experienced a loss of about $170 per Bitcoin, dropping from a relatively stable $3,600 to $3,435. The news that Steve Wozniak sold BTC at the all-time high was made public at around 27th of January. Unless that was the news story that moved the markets, we have to mark this one to a speculative dump by a whale or a group of crypto investors making an exit. Apart from that loss, the market seems quite stable with minimal levels of volatility pervading the charts.

January 23rd

Cboe withdraws VanEck-SolidX Bitcoin ETF proposal

Whether it was caused by the U.S. government shutdown, an internal struggle in handling the situation with the SEC, or simply an executive decision to back away from the venture, one thing is clear. Cboe has decided to withdraw their proposal to the SEC in regards to the VanEck-SolidX physically-settled Bitcoin ETF, which would have been the first in the world, once approved.

The fed has until 27th of February to make a decision, but now since the proposal is off the table, institutional investors were disappointed to discover that their long-awaited ETF proposal will not get the closure it deserved. Gabor Grubacs, VanEck’s director of digital strategy, told Coindesk that the proposal is only temporarily withdrawn and that they are actively working with the regulatory body and major market forces to create the necessary structural framework for Bitcoin ETFs and digital assets.

From our perspective it seems that the proposal has been withdrawn prematurely, not giving the opportunity for the governmental situation in the U.S. to stabilize. The executives leading the proposal are simply not confident enough that the SEC can potentially approve, as many of them have expressed their concerns.

They claim that the SEC would sooner decline the proposal, well before it can have the chance to be approved on a technicality. Once again, this is rather premature and may point to a back-door strategy that the organization may have started to fear approval.

- Rumors arise about a Telegram platform (TON) release in March

- NASDAQ invests $20 million in a blockchain startup

- $11.4 million crypto thief arrested in Oxford

- Binance announces OTC trading desk

January 24th

IMF highlights blockchain adoption on Malta to carry significant risks

The International Monetary Fund (IMF) executed a regular mission on Malta which is an annual part of the Fund’s regular activities. The mission concluded on January 16th, but it took some time for results to reach the public, revealing concerns in regards to blockchain and crypto-adoption.

The mission looked at a couple of factors such as:

- Financial Sector

- Housing Market

- Fiscal Policy

- Structural Reforms

For the purposes of our article, we will only look at blockchain related information found in the full report. According to the IMF’s staff report, Malta needs to focus on the effective implementation of Anti Money Laundering and the Countering of Financing Terrorism which is deemed critical in the safeguarding of the country’s financial integrity and stability, as well as their role as a financial center.

Malta’s financial and gaming sectors, together with the vision of attracting blockchain-related companies place the country in the responsible position of being internationally connected, and according to the IMF these associations cause Money Laundering and Terrorist Financing risks. The report calls on Malta to undertake immediate action to close supervisory and enforcement gaps and to take steps to understand the risks and identification efforts.

- Robinhood claims the New York trading license

- Hacker claims to have access to secure exchange user data

- Ripple’s CEO: “I’m not prepared to say that Bitcoin goes to zero”

- IBM announces blockchain-based ecosystem for healthcare

- Harvard, Levi Strauss collaboration for worker safety

- Blockchain companies in Liechtenstein and Switzerland on the rise

- EOS ranked #1 blockchain produc by the Chinese government

- tZERO, Overstock’s Security Token Trading platform goes live

January 25th

Four South Korean exchanges form AML initiative

In the wake of hundreds of thefts, misappropriations, and straight up scams, and other criminal misdoings seeing their end, South Korean exchange leadership took action to start the nation’s regulatory advancement in terms of AML and CTF.

The four exchanges are:

- Upbit

- Korbit

- Coinone

- Bithumb

They’ve created a hotline between themselves which enables the organizations to communicate issues that support user protection and fraud detection. Issues such as voice phishing, predatory lending, schemes are the main target for this implementation, which will enable the exchanges to protect their own users.

Scammers will no longer be able to leverage the existence of different exchanges in the country to retrieve their ill-gotten gains. The initiative will overall improve the quality of the crypto ecosystem in the country, enabling higher levels of user protection, as well as placing the exchanges in a better position in the case of criminal activity, enabling them to help the police with more relevant and complete information.

- Bitstamp partners with Swiss bank to facilitate BTC usage for clients

- Bitwise files ETF proposal to the SEC

- Bakkt releases details regarding the daily BTC futures contract

- LA Bakery has their Bitcoin ATM stolen

- Latest Samsung smartphone may come with a cryptocurrency wallet built-in

January 26th

“Not your vault, not your gold” – Kraken CEO comments on Maduro not being able to withdraw his gold

Whether or not you want to support a dictator in Venezuela is a completely different question, but when it comes down to ownership, we should all have access to our own property, regardless if we are a president of a country with the help of an army against impoverished citizens. Right?

Well, the powers that be, in this case the United States of America have once again sanctioned Venezuela’s dictator/president Maduro, by instructing the U.K. not to release the gold that was requested by the leader. Kraken’s CEO, Jesse Powell took the opportunity to give his own opinion on the matter by making a play on Andreas’ expression “Not your keys, not your Bitcoin”:

Venezuela’s going through a rough spot, as Nicolas Maduro tried to hold onto the authoritative position that he has claimed, and if the country’s property was in Bitcoin, there would be no third party to have any say whatsoever as to what happens to the assets.

In some cases this is a good thing, but we can see the limiting factors over the freedom of making a decision. It’s not uncommon for media, organizations, and countries to paint a picture about someone, and before you know it you or me could become Nicolas Maduro, not being able to access our assets, whether they are stored in the bank or kept by another third-party custodian.

- Blockchain startup R3 loses two top-tier management executives

- Binance denies being affected by hacked user data

- Nouriel: “Blockchain is no more than an Excel spreadsheet”

- Taiwanese scam shutdown as more than 12 people are arrested

January 27th

Cryptocurrency startup under fire by the SEC, promises to fight back for the entire community

Is every ICO a security? If you ask any of the staff members of the SEC, the answer would a resound “Yes.” But is that really the case?

Kik, an instant messenger that was funded through an ICO in early 2017, held off on releasing their “Kin” token (due to technical issues and subpoenas) which is currently used in more than 30 apps on the Google Play and iOS App stores, in addition to the instant messaging application.

Now, the SEC is considering taking this start-up to court, under the assumption that they’ve created a security, which the startup’s leadership fiercely defends that it is not. “Kin was created to be a currency for the digital world. We’ve never detailed the cryptocurrency to be anything other than a means to exchange with other users on the application,” says Ted Livingston, founder and CEO of both Kik and Kin.

He explains that his conviction in Kin being a real currency is grounded in reality, and that he would be glad to fight the SEC in court. He considers that Kin is a real currency and has nothing to do with any profit-sharing agreements, nor it was ever marketed as an investment vehicle.

They’ve taken this case into the public realm and are speaking about it as openly as humanly possible, giving us an insight into their situation. The team seriously leverages their awkward position and uses the negative attention to generate a wider userbase for their cryptocurrency and application, claiming this is a historic case for crypto innovation in the United States.

- Marshall Island’s Sovereign will have physical blockchain banknotes

- Italy makes the first steps towards blockchain legislation

- Steve Wozniak sold all BTC at $16-20k

- South Korea continues to make waves in crypto

- Iran getting closer to state-backed cryptocurrency

January 28th

Eleven Indian banks to create a blockchain-powered financing program for SMEs

India does not like cryptocurrencies, but the country’s national bank or legislators have no issue with blockchain technology. The banks have joined together to mitigate the risks of lending to smaller companies that tend to default on their loans.

Abhijeet Singh, head of business technology at ICICI, says the idea of organizing in this way is to remove the communication hurdles between the major banks. According to him, a requirement for a blockchain network to thrive is for the entire ecosystem (in this case the banks) to converge on a single network and pool their forces in synergy.

The main goal of the consortium and organization is to ensure the transparency in credit disbursement, meaning money paid out by the banks. The network will also help the banks access public credit data, helping them make logical decisions instead of relying on risk-assessment. Initially, the banks will set up a network for the entire lending supply-chain in the country and help digitize all of the information.

While it is not our ideal target, we are happy to see development in blockchain happening in India, and secretly hoping that it will lead to the removal of the ban on cryptocurrencies in the country.

- Nestle to opt-in IBM’s Food Trust to provide transparency to products

- Chicago now has 100+ cryptocurrency ATMs

- Chinese plastic film Fuwei Film company acquires blockchain development company Gold Glory

January 29th

Iran’s Central Bank releases regulatory framework

During the annual Iranian Electronic Banking and Payment System Conference, representatives from the Central Bank of Iran announced the new draft regulations on cryptocurrency, as reported by Al Jazeera.

The regulatory framework recognizes cryptocurrencies and blockchain technology, but still continues to limit the interaction of cryptos within the country. As part of the regulatory draft, it is deemed illegal for individuals to accept crypto payments within the country, as well as limits the ownership potential of citizens to $10k worth of value. The crypto community in Iran is outraged in regards to the proposed draft, but regulators promise to take their feedback into consideration. The current version of the draft is considered to be “Version 0.0” indicating the very beginning of Iran making its mind up in regards to crypto.

The regulatory framework also includes government-backed cryptocurrencies, for which we know that Iran has had a plan for a while now, making it a real need for them to start to include cryptocurrencies and blockchain in their legal framework. Iran has been looking towards the creation of this cryptocurrency as a way to mitigate U.S. sanctions and eliminate reliance on the American dollar, while potentially strengthening their own economical situation.

Interestingly enough, the framework includes and enables ICOs and tokens, cryptocurrency exchanges, and the act of mining. Once these changes are implemented, the ban which the country had under effect will be void.

- BCH forms partnership with Alliance Group

- Fidelity to launch Bitcoin Custody service in March

- EOS overtakes ETH-powered gambling

- Terror group “Hamas” calls on supporters to send Bitcoin

That’s it for this week. As always, share your opinions about the most interesting ones or link those stories we might have missed in our collections, which you found interesting and noteworthy over the week. You can also send us suggestions of stories to include in the next list if you find something interesting over the next days.

- Google +

- VK

Featured Images via Pexels and Unsplash.

Source: Read Full Article